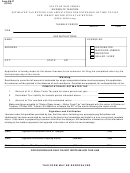

Instructions to Complete Form GA-IT

This form is be used by Motor Fuel Distributors, Jobbers, Importers and Seller/User holders requesting

an extension of time to file New Jersey Motor Fuel Tax Return. However, as an alternative to filing this

report the Division of Taxation will accept wire transfers of estimated payments in lieu of a check or

money order. Such transfers must be made on or before the twentieth day of the month to ensure the

granting of an automatic extension of time for filing. Transfers should be addressed as follows:

RECEIVING BANK ..................................................... NEW JERSEY NATIONAL BANK

TELEGRAPHIC ABBBEVIATION .............................. NJ NATL TRENTON

A.B.A. BANK NUMBER............................................... 031200730

ADDRESSEE ............................................................. STATE OF NEW JERSEY

MOTOR FUELS TAX

ACCOUNT NUMBER ................................................. 000-003-7

In order for an extension to be approved the Division of Taxation must receive an estimated payment as

outlined above or receive this form on or before the twentieth day of the month following the report

month.

Note: Taxpayers with a "zero" tax liability must nevertheless file this return in order to be

granted an extension to file their report.

An estimated payment must accompany this return. This estimated payment should be 100% of the tax

liability for the reporting period, however, penalties will not be imposed if the payment meets one (1) of

the following conditions:

1. 100% of the tax payment made for the same reporting period of the prior year (Line 6 1)

2. or, 95% of the current reporting month's tax liability (Line 8 2)

If the estimated payment meets one of these criteria, a late filing penalty will not be imposed. However,

interest will be billed for any underpayment of tax.

The return on extension must be filed by the last business day of the month.

Overpayments of tax resulting from a higher estimated payment than necessary will be carried as credits

against the following month's payment unless a refund is specifically requested in writing.

Important: Indicate the license type and license number in the space provided. Insure that this return is

signed.

1

1 2

2