Form Cert-100 - Materials, Tools, And Fuel

ADVERTISEMENT

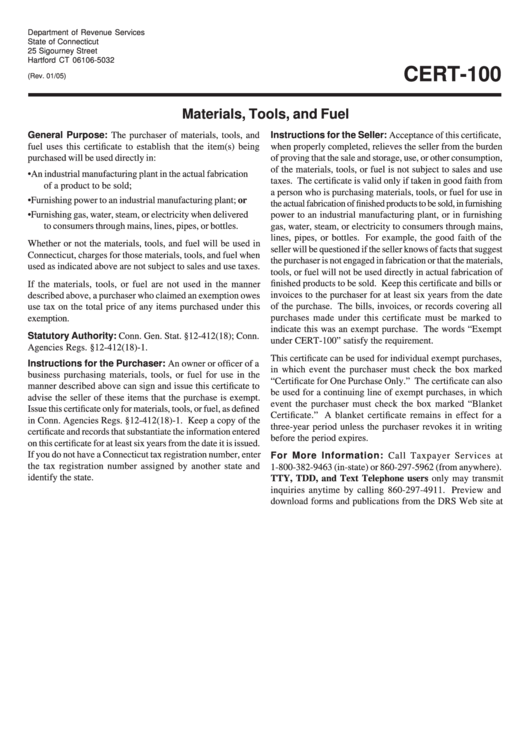

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-100

(Rev. 01/05)

Materials, Tools, and Fuel

General Purpose: The purchaser of materials, tools, and

Instructions for the Seller: Acceptance of this certificate,

fuel uses this certificate to establish that the item(s) being

when properly completed, relieves the seller from the burden

purchased will be used directly in:

of proving that the sale and storage, use, or other consumption,

of the materials, tools, or fuel is not subject to sales and use

•

An industrial manufacturing plant in the actual fabrication

taxes. The certificate is valid only if taken in good faith from

of a product to be sold;

a person who is purchasing materials, tools, or fuel for use in

•

Furnishing power to an industrial manufacturing plant; or

the actual fabrication of finished products to be sold, in furnishing

•

Furnishing gas, water, steam, or electricity when delivered

power to an industrial manufacturing plant, or in furnishing

to consumers through mains, lines, pipes, or bottles.

gas, water, steam, or electricity to consumers through mains,

lines, pipes, or bottles. For example, the good faith of the

Whether or not the materials, tools, and fuel will be used in

seller will be questioned if the seller knows of facts that suggest

Connecticut, charges for those materials, tools, and fuel when

the purchaser is not engaged in fabrication or that the materials,

used as indicated above are not subject to sales and use taxes.

tools, or fuel will not be used directly in actual fabrication of

finished products to be sold. Keep this certificate and bills or

If the materials, tools, or fuel are not used in the manner

invoices to the purchaser for at least six years from the date

described above, a purchaser who claimed an exemption owes

of the purchase. The bills, invoices, or records covering all

use tax on the total price of any items purchased under this

purchases made under this certificate must be marked to

exemption.

indicate this was an exempt purchase. The words “Exempt

Statutory Authority: Conn. Gen. Stat. §12-412(18); Conn.

under CERT-100” satisfy the requirement.

Agencies Regs. §12-412(18)-1.

This certificate can be used for individual exempt purchases,

Instructions for the Purchaser: An owner or officer of a

in which event the purchaser must check the box marked

business purchasing materials, tools, or fuel for use in the

“Certificate for One Purchase Only.” The certificate can also

manner described above can sign and issue this certificate to

be used for a continuing line of exempt purchases, in which

advise the seller of these items that the purchase is exempt.

event the purchaser must check the box marked “Blanket

Issue this certificate only for materials, tools, or fuel, as defined

Certificate.” A blanket certificate remains in effect for a

in Conn. Agencies Regs. §12-412(18)-1. Keep a copy of the

three-year period unless the purchaser revokes it in writing

certificate and records that substantiate the information entered

before the period expires.

on this certificate for at least six years from the date it is issued.

If you do not have a Connecticut tax registration number, enter

For More Information: Call Taxpayer Services at

the tax registration number assigned by another state and

1-800-382-9463 (in-state) or 860-297-5962 (from anywhere).

identify the state.

TTY, TDD, and Text Telephone users only may transmit

inquiries anytime by calling 860-297-4911. Preview and

download forms and publications from the DRS Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2