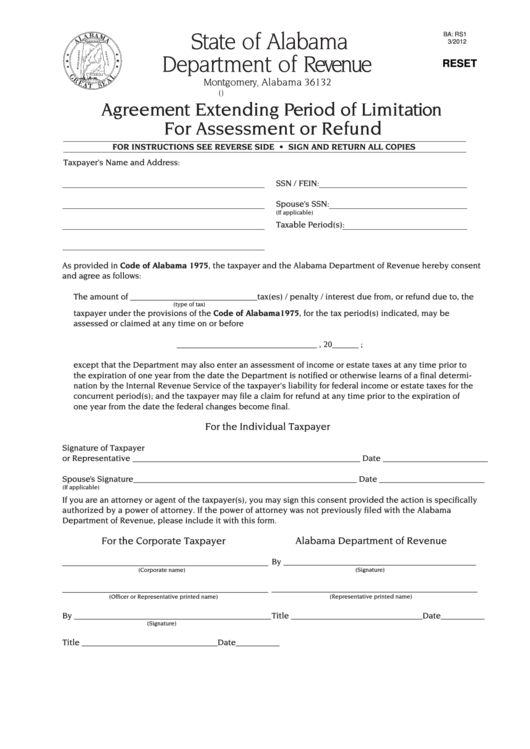

State of Alabama

BA: RS1

3/2012

Department of Revenue

RESET

Montgomery, Alabama 36132

( )

Agreement Extending Period of Limitation

For Assessment or Refund

FOR INSTRUCTIONS SEE REVERSE SIDE • SIGN AND RETURN ALL COPIES

Taxpayer’s Name and Address:

SSN / FEIN:

Spouse’s SSN:

(If applicable)

Taxable Period(s):

As provided in Code of Alabama 1975, the taxpayer and the Alabama Department of Revenue hereby consent

and agree as follows:

The amount of _____________________________ tax(es) / penalty / interest due from, or refund due to, the

(type of tax)

taxpayer under the provisions of the Code of Alabama 1975, for the tax period(s) indicated, may be

assessed or claimed at any time on or before

________________________________ , 20______ ;

except that the Department may also enter an assessment of income or estate taxes at any time prior to

the expiration of one year from the date the Department is notified or otherwise learns of a final determi-

nation by the Internal Revenue Service of the taxpayer’s liability for federal income or estate taxes for the

concurrent period(s); and the taxpayer may file a claim for refund at any time prior to the expiration of

one year from the date the federal changes become final.

For the Individual Taxpayer

Signature of Taxpayer

or Representative ____________________________________________________ Date ________________________

Spouse’s Signature ___________________________________________________ Date ________________________

(If applicable)

If you are an attorney or agent of the taxpayer(s), you may sign this consent provided the action is specifically

authorized by a power of attorney. If the power of attorney was not previously filed with the Alabama

Department of Revenue, please include it with this form.

For the Corporate Taxpayer

Alabama Department of Revenue

_______________________________________________

By ____________________________________________

(Signature)

(Corporate name)

_______________________________________________

_______________________________________________

(Officer or Representative printed name)

(Representative printed name)

By _____________________________________________

Title ______________________________ Date__________

(Signature)

Title _______________________________ Date__________

1

1 2

2