PLEASE NOTE

The Alabama Department of Revenue requires employers submitting 25 or more W-2’s

to electronically submit both the Form A-3 and W-2’s on-line.

Please click here to electronically file your Form A-3 and W-2’s on-line.

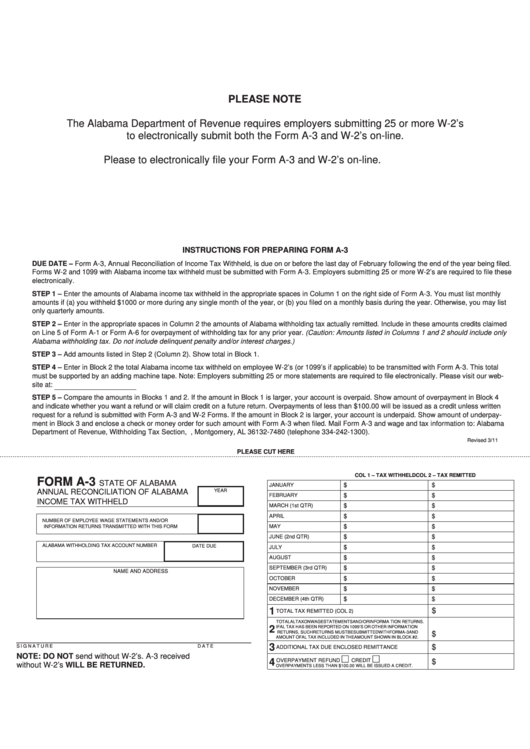

INSTRUCTIONS FOR PREPARING FORM A-3

DUE DATE – Form A-3, Annual Reconciliation of Income Tax Withheld, is due on or before the last day of February following the end of the year being filed.

Forms W-2 and 1099 with Alabama income tax withheld must be submitted with Form A-3. Employers submitting 25 or more W-2’s are required to file these

electronically.

STEP 1 – Enter the amounts of Alabama income tax withheld in the appropriate spaces in Column 1 on the right side of Form A-3. You must list monthly

amounts if (a) you withheld $1000 or more during any single month of the year, or (b) you filed on a monthly basis during the year. Otherwise, you may list

only quarterly amounts.

STEP 2 – Enter in the appropriate spaces in Column 2 the amounts of Alabama withholding tax actually remitted. Include in these amounts credits claimed

on Line 5 of Form A-1 or Form A-6 for overpayment of withholding tax for any prior year. (Caution: Amounts listed in Columns 1 and 2 should include only

Alabama withholding tax. Do not include delinquent penalty and/or interest charges.)

STEP 3 – Add amounts listed in Step 2 (Column 2). Show total in Block 1.

STEP 4 – Enter in Block 2 the total Alabama income tax withheld on employee W-2’s (or 1099’s if applicable) to be transmitted with Form A-3. This total

must be supported by an adding machine tape. Note: Employers submitting 25 or more statements are required to file electronically. Please visit our web-

site at: for more information.

STEP 5 – Compare the amounts in Blocks 1 and 2. If the amount in Block 1 is larger, your account is overpaid. Show amount of overpayment in Block 4

and indicate whether you want a refund or will claim credit on a future return. Overpayments of less than $100.00 will be issued as a credit unless written

request for a refund is submitted with Form A-3 and W-2 Forms. If the amount in Block 2 is larger, your account is underpaid. Show amount of underpay-

ment in Block 3 and enclose a check or money order for such amount with Form A-3 when filed. Mail Form A-3 and wage and tax information to: Alabama

Department of Revenue, Withholding Tax Section, P.O. Box 327480, Montgomery, AL 36132-7480 (telephone 334-242-1300).

Revised 3/11

PLEASE CUT HERE

COL 1 – TAX WITHHELD

COL 2 – TAX REMITTED

FORM A-3

STATE OF ALABAMA

JANUARY

$

$

YEAR

ANNUAL RECONCILIATION OF ALABAMA

FEBRUARY

$

$

INCOME TAX WITHHELD

MARCH (1st QTR)

$

$

APRIL

$

$

NUMBER OF EMPLOYEE WAGE STATEMENTS AND/OR

MAY

$

$

INFORMATION RETURNS TRANSMITTED WITH THIS FORM

JUNE (2nd QTR)

$

$

ALABAMA WITHHOLDING TAX ACCOUNT NUMBER

DATE DUE

JULY

$

$

AUGUST

$

$

SEPTEMBER (3rd QTR)

$

$

NAME AND ADDRESS

OCTOBER

$

$

NOVEMBER

$

$

DECEMBER (4th QTR)

$

$

1

$

TOTAL TAX REMITTED (COL 2)

TOTALAL TAX ON WAGE STATEMENTS AND/OR INFORMATION RETURNS.

IF AL TAX HAS BEEN REPORTED ON 1099’S OR OTHER INFORMATION

2

RETURNS, SUCH RETURNS MUST BE SUBMITTED WITH FORM A-3 AND

$

_________________________________________

AMOUNT OF AL TAX INCLUDED IN THE AMOUNT SHOWN IN BLOCK #2.

3

SIGNATURE

DATE

$

ADDITIONAL TAX DUE ENCLOSED REMITTANCE

NOTE: DO NOT send without W-2’s. A-3 received

4

OVERPAYMENT REFUND

CREDIT

$

without W-2’s WILL BE RETURNED.

OVERPAYMENTS LESS THAN $100.00 WILL BE ISSUED A CREDIT.

1

1