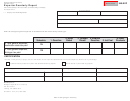

Form 3724, Page 2

800-TRN

Instructions for Form 3724, Transporter Quarterly Report

This report must be filed quarterly by carriers who transport motor fuel

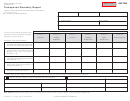

Michigan Fuel Product Codes

into or out of this state for another person. Transportation vehicles

Gasoline

include railroad or rail car, tank wagon, transport truck or any other fuel

transportation vehicle. A transporter is engaged in the business of trans-

Natural Gasoline ......................................... 061

porting motor fuel below the terminal rack.

Gasoline ....................................................... 065

LINE INSTRUCTIONS.

Gasoline MTBE ........................................... 071

Transmix ...................................................... 100

(Lines not listed below are explained on the form.)

Blending Components ................................ 122

Line 1: Indicate changes to the company name and address by crossing

out incorrect information and entering correct information.

Napthas ........................................................ 126

Line 2: Enter taxpayer Federal Identification Number (FEIN or TR).

Toluene ........................................................ 199

Raffinates ..................................................... 223

Line 2A: Enter taxpayer’s 8-digit license number.

Line 3: Report Period. Enter the report period (example 06/2001 or

Liquid Natural Gas ...................................... 225

June 2001).

Ethanol and Ethanol Blends

Lines 4-7. Enter the name, phone number, fax number, and e-mail ad-

Product Codes for Ethanol and Ethanol blends will now be reported

dress of the individual who may be contacted for questions.

according to the blend percentage. The prefix will be “E” plus the per-

Lines 8-12: Complete Lines 8-12, enter the combined total of all the

centage. Example: A blend of 10% Ethanol and 90% Gasoline will be

schedules for each Fuel Product listed in Columns 1-5.

reported as E10. Ethanol (100%) will be reported as E00. All ethanol and

Column 6, Other Products.

ethanol blends will be taxed as gasoline at the 19 cents tax rate.

When reporting “Other Products” not identified in Columns 1-5 on Page

Undyed Diesel

1, enter the combined total of all the schedules for “Other Products.”

Kerosene - undyed ...................................... 142

Low Sulfur Kerosene - undyed ................. 145

High Sulfur Kerosene - undyed ................. 147

Product Codes (PC)

No. 1 Fuel Oil - undyed ............................. 150

Enter the appropriate product code on Form 3779, Transporter Schedule

Heating Oil .................................................. 152

of Deliveries or Diversions. See attached list of product codes.

Diesel Fuel #4 - undyed ............................. 154

Diesel Fuel - undyed ................................... 160

Low Sulfur diesel # 1 - undyed ................. 161

Low Sulfur diesel # 2 - undyed ................. 167

Mineral Oils ................................................. 281

# 1 High Sulfur Diesel - undyed ................ 282

# 2 High Sulfur Diesel - undyed ................ 283

1

1 2

2 3

3