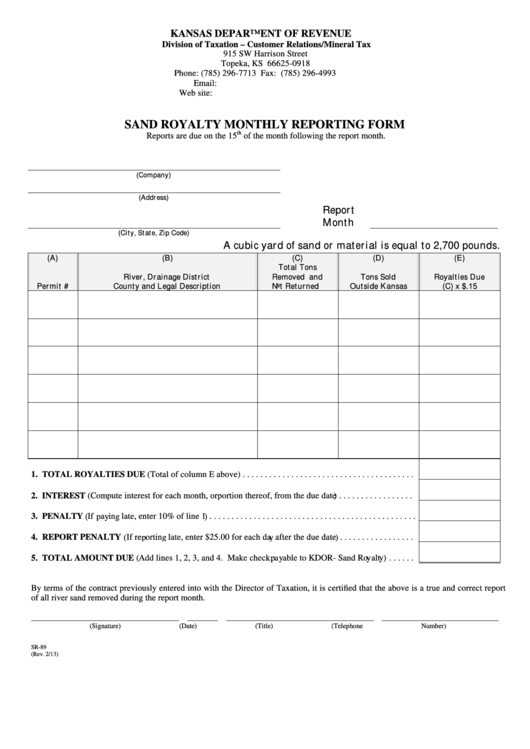

KANSAS DEPARTMENT OF REVENUE

Division of Taxation – Customer Relations/Mineral Tax

915 SW Harrison Street

Topeka, KS 66625-0918

Phone: (785) 296-7713

Fax: (785) 296-4993

Email: margo.segura-ranel@kdor.ks.gov

Web site:

SAND ROYALTY MONTHLY REPORTING FORM

th

Reports are due on the 15

of the month following the report month.

(Company)

(Address)

Report

Month

(City, State, Zip Code)

A cubic yard of sand or material is equal to 2,700 pounds.

(A)

(B)

(C)

(D)

(E)

Total Tons

River, Drainage District

Removed and

Tons Sold

Royalties Due

Permit #

County and Legal Description

Not Returned

Outside Kansas

(C) x $.15

1. TOTAL ROYALTIES DUE (Total of column E above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. INTEREST (Compute interest for each month, or portion thereof, from the due date) . . . . . . . . . . . . . . . . .

3. PENALTY (If paying late, enter 10% of line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. REPORT PENALTY (If reporting late, enter $25.00 for each day after the due date) . . . . . . . . . . . . . . . . .

5. TOTAL AMOUNT DUE (Add lines 1, 2, 3, and 4. Make check payable to KDOR- Sand Royalty) . . . . . .

By terms of the contract previously entered into with the Director of Taxation, it is certified that the above is a true and correct report

of all river sand removed during the report month.

(Signature)

(Date)

(Title)

(Telephone Number)

SR-89

(Rev. 2/13)

1

1