Page 1

IT-565i (1/13)

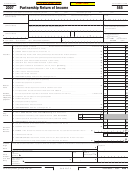

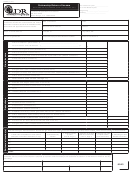

Instructions for Completing Form IT-565

Partnership Return of Income

Louisiana Department of Revenue

P. O. Box 3440

Baton Rouge, LA 70821-3440

Partnerships not required to file a return

(2). A principal partner is one who has an interest of five percent or more

A partnership return is not required if all partners are natural persons

in the partnership profits or capital.

who are residents of Louisiana (R.S. 47:201).

Accrued or received income

Partnerships that must file a return

If records are kept on an accrual basis, report all income accrued, even

Any partnership doing business in Louisiana or deriving any income

though it has not been actually received or entered in the records, and

from sources therein, regardless of the amount and regardless of the

report all expenses incurred, not just expenses paid.

residence of the partners, must file a return of income on Form IT-565

If records do not show income accrued and expenses incurred, report

if any partner is a nonresident of Louisiana or if any partner is not a

all income received or constructively received, such as bank interest

natural person. If the partnership has income that is derived from sources

credited to your account and expenses paid.

partly within and partly outside of Louisiana, Form IT-565B must be

filed with Form IT-565. The term “partnership” includes syndicates,

Penalties

groups, pools, joint ventures, or other unincorporated organizations,

The penalty for willfully making a false or fraudulent return or for

through or by means of which any business, financial operation, or

willful failure to make and file the return on time shall not be more

venture is carried on, and that are not trusts, estates, or corporations

than $1,000, or imprisonment for not more than one year, or both,

within the meaning of the Louisiana Income Tax Law.

and shall include the costs of prosecution.

Income tax returns of partners

Income items exempt from tax

Each partner that is a natural person must include on his individual

The following are some types of income that are exempt from Louisiana

return, his distributive share, whether or not such share is distributed

income tax and should not be included in gross income:

to or withdrawn by the partner, the net income of the partnership

(a) Amounts received under a life insurance contract paid by reason

during the partnership’s accounting period (whether fiscal or calendar

of the death of the insured and paid at the death of the insured.

year), that ended during his taxable year (whether fiscal or calendar

For treatment of amounts paid at a date later than death, see R.S.

year). Form IT-540 is for resident individuals. A nonresident member

47:43(D).

of a partnership who does not have a valid agreement on file with LDR

must be included in a Composite Partnership Return (Form R-6922).

(b) That portion of an annuity that represents a return of the taxpay-

Nonresident partners who have a valid agreement or who have other

er’s investment. (See R.S. 47:44.)

income derived from Louisiana sources, must include all income derived

(c) Gifts (not received as a consideration for services rendered) and

from Louisiana sources on Form IT-540B.

money and property acquired by bequest, devise, or inheritance.

Individuals should use the information reported on the federal

However, the income derived from such property is taxable.

partnership return instead of the amounts shown in the partners’

allocation schedule. Corporations should refer to LRS-47:287.93(A)(5).

(d) Interest on obligations of the United States Government and/or

its instrumentalities.

When and where the return must be filed

(e) Interest on obligations of the State of Louisiana and its political

Returns for a calendar year must be filed with the Department of

or municipal subdivisions to the extent as is now exempt by law.

Revenue, Box 3440, Baton Rouge, LA 70821-3440, on or before May

15 of the year following the close of the calendar year. Returns for fiscal

List in Schedule K all items of income reported on your Federal return,

years must be filed on or before the 15th day of the fifth month after

but not on your Louisiana return.

the close of the fiscal period.

Information at the source

Period to be covered by return

Any person, firm, partnership, trust, corporation, or organization

The return must be filed for a calendar year, or for a fiscal year of 12

making payments totaling $1,000 or more during any calendar year for

months, ending on the last day of any month other than December,

lease bonuses, delay rentals, and/or royalties respecting mineral leases

or for an annual period of 52/53 weeks, if records are kept on this

affecting lands located in Louisiana and rentals paid with respect to

basis. You must clearly indicate the beginning and ending dates being

real property located in Louisiana to a nonresident individual or a firm,

covered at the top of the return. The accounting period established

partnership, trust, corporation, or organization not located in Louisiana

on the first return must be adhered to for subsequent years under

shall file an information return with the Secretary of Revenue on or

Louisiana Income Tax Law, unless permission to make a change is

before June 1 of the following year for each such payee. The return shall

received from the Secretary of Revenue.

include the name, address, Federal Employer Identification Number,

A change by any partnership from one taxable year to another, or the

and/or Social Security Number of both the payor and payee. There

adoption by a new partnership for an initial taxable year, must meet the

shall also be included the amount and description of payments to

provisions of R.S. 47:206(B)(1). A change by a principal partner from

each such payee. The Federal Information Return Form (Form 1099)

one taxable year to another must meet the provisions of R.S. 47:206(B)

for reporting such payments may be used for reporting the required

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11