Instructions For Worksheet B - Income Allocation Worksheet For Part-Year Residents/nonresidents/"Safe Harbor" Residents

ADVERTISEMENT

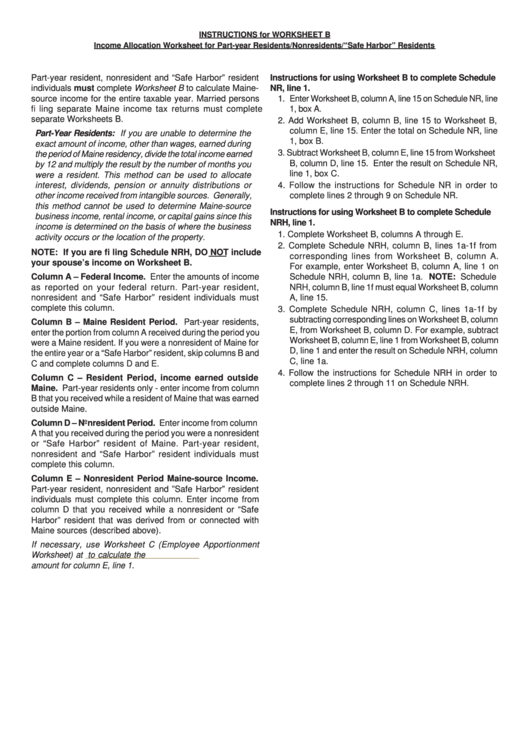

INSTRUCTIONS for WORKSHEET B

Income Allocation Worksheet for Part-year Residents/Nonresidents/“Safe Harbor” Residents

Part-year resident, nonresident and “Safe Harbor” resident

Instructions for using Worksheet B to complete Schedule

individuals must complete Worksheet B to calculate Maine-

NR, line 1.

source income for the entire taxable year. Married persons

1. Enter Worksheet B, column A, line 15 on Schedule NR, line

fi ling separate Maine income tax returns must complete

1, box A.

separate Worksheets B.

2. Add Worksheet B, column B, line 15 to Worksheet B,

column E, line 15. Enter the total on Schedule NR, line

Part-Year Residents: If you are unable to determine the

1, box B.

exact amount of income, other than wages, earned during

3. Subtract Worksheet B, column E, line 15 from Worksheet

the period of Maine residency, divide the total income earned

B, column D, line 15. Enter the result on Schedule NR,

by 12 and multiply the result by the number of months you

line 1, box C.

were a resident. This method can be used to allocate

interest, dividends, pension or annuity distributions or

4. Follow the instructions for Schedule NR in order to

other income received from intangible sources. Generally,

complete lines 2 through 9 on Schedule NR.

this method cannot be used to determine Maine-source

Instructions for using Worksheet B to complete Schedule

business income, rental income, or capital gains since this

NRH, line 1.

income is determined on the basis of where the business

1. Complete Worksheet B, columns A through E.

activity occurs or the location of the property.

2. Complete Schedule NRH, column B, lines 1a-1f from

NOTE: If you are fi ling Schedule NRH, DO NOT include

corresponding lines from Worksheet B, column A.

your spouse’s income on Worksheet B.

For example, enter Worksheet B, column A, line 1 on

Column A – Federal Income. Enter the amounts of income

Schedule NRH, column B, line 1a. NOTE: Schedule

as reported on your federal return. Part-year resident,

NRH, column B, line 1f must equal Worksheet B, column

nonresident and “Safe Harbor” resident individuals must

A, line 15.

complete this column.

3. Complete Schedule NRH, column C, lines 1a-1f by

subtracting corresponding lines on Worksheet B, column

Column B – Maine Resident Period. Part-year residents,

E, from Worksheet B, column D. For example, subtract

enter the portion from column A received during the period you

Worksheet B, column E, line 1 from Worksheet B, column

were a Maine resident. If you were a nonresident of Maine for

D, line 1 and enter the result on Schedule NRH, column

the entire year or a “Safe Harbor” resident, skip columns B and

C, line 1a.

C and complete columns D and E.

4. Follow the instructions for Schedule NRH in order to

Column C – Resident Period, income earned outside

complete lines 2 through 11 on Schedule NRH.

Maine. Part-year residents only - enter income from column

B that you received while a resident of Maine that was earned

outside Maine.

Column D – Nonresident Period. Enter income from column

A that you received during the period you were a nonresident

or “Safe Harbor” resident of Maine. Part-year resident,

nonresident and “Safe Harbor” resident individuals must

complete this column.

Column E – Nonresident Period Maine-source Income.

Part-year resident, nonresident and ”Safe Harbor” resident

individuals must complete this column. Enter income from

column D that you received while a nonresident or “Safe

Harbor” resident that was derived from or connected with

Maine sources (described above).

If necessary, use Worksheet C (Employee Apportionment

Worksheet) at

to calculate the

amount for column E, line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1