Form Et-141 - New York State Estate Tax Domicile Affidavit

ADVERTISEMENT

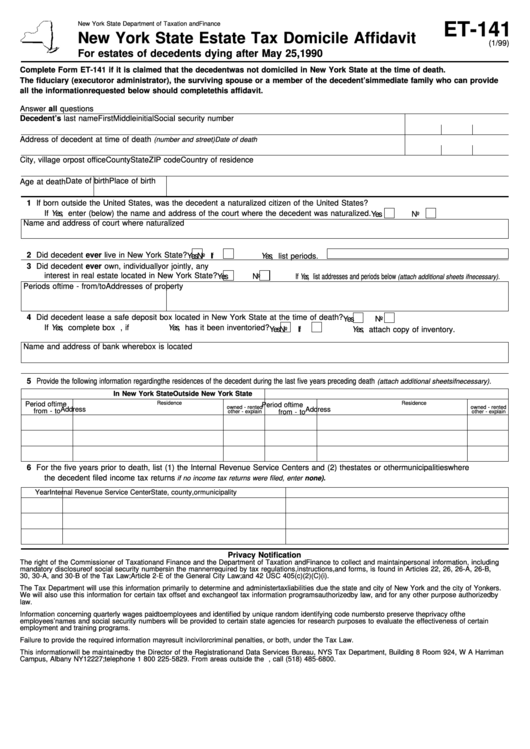

ET-141

New York State Department of Taxation and Finance

New York State Estate Tax Domicile Affidavit

(1/99)

For estates of decedents dying after May 25, 1990

Complete Form ET-141 if it is claimed that the decedent was not domiciled in New York State at the time of death.

The fiduciary (executor or administrator), the surviving spouse or a member of the decedent’s immediate family who can provide

all the information requested below should complete this affidavit.

Answer all questions completely. Attach this form to Form ET-90 or Form ET-85.

Decedent’s last name

First

Middle initial

Social security number

Address of decedent at time of death

(number and street)

Date of death

City, village or post office

County

State

ZIP code Country of residence

Date of birth

Place of birth

Age at death

1 If born outside the United States, was the decedent a naturalized citizen of the United States?

If Yes, enter (below) the name and address of the court where the decedent was naturalized.

Yes

No

Name and address of court where naturalized

2 Did decedent ever live in New York State?

No If Yes, list periods.

Yes

3 Did decedent ever own, individually or jointly, any

interest in real estate located in New York State?

Yes

No

If Yes, list addresses and periods below

(attach additional sheets if necessary).

Periods of time - from / to

Addresses of property

4 Did decedent lease a safe deposit box located in New York State at the time of death?

Yes

No

If Yes, complete box below. Also, if Yes, has it been inventoried?

Yes

No

If Yes, attach copy of inventory.

Name and address of bank where box is located

5 Provide the following information regarding the residences of the decedent during the last five years preceding death

(attach additional sheets if necessary).

In New York State

Outside New York State

Residence

Residence

Period of time

Period of time

owned - rented

owned - rented

Address

Address

from - to

from - to

other - explain

other - explain

6 For the five years prior to death, list (1) the Internal Revenue Service Centers and (2) the states or other municipalities where

the decedent filed income tax returns

if no income tax returns were filed, enter none).

Year

Internal Revenue Service Center

State, county, or municipality

Privacy Notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal information, including

mandatory disclosure of social security numbers in the manner required by tax regulations, instructions, and forms, is found in Articles 22, 26, 26-A, 26-B,

30, 30-A, and 30-B of the Tax Law; Article 2-E of the General City Law; and 42 USC 405(c)(2)(C)(i).

The Tax Department will use this information primarily to determine and administer tax liabilities due the state and city of New York and the city of Yonkers.

We will also use this information for certain tax offset and exchange of tax information programs authorized by law, and for any other purpose authorized by

law.

Information concerning quarterly wages paid to employees and identified by unique random identifying code numbers to preserve the privacy of the

employees’ names and social security numbers will be provided to certain state agencies for research purposes to evaluate the effectiveness of certain

employment and training programs.

Failure to provide the required information may result in civil or criminal penalties, or both, under the Tax Law.

This information will be maintained by the Director of the Registration and Data Services Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman

Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2