Form Dr-312 - Affidavit Of No Florida Estate Tax Due Page 2

ADVERTISEMENT

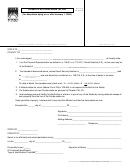

DR-312

R. 06/11

Page 2

Instructions for Completing Form DR-312

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

Federal thresholds for filing federal Form 706 only:

(For informational purposes only. Please confirm with

If Florida estate tax is not due and a federal estate tax

Form 706 instructions.)

return (federal Form 706 or 706-NA) is not required to

be filed, the personal representatives of such estates

Date of Death

Dollar Threshold

should complete Florida Form DR-312, Affidavit of

(year)

for Filing Form 706

No Florida Estate Tax Due. Note that the definition

(value of gross estate)

of “personal representative” in Chapter 198, F.S.,

includes any person who is in actual or constructive

1998

$625,000

possession. Therefore, this affidavit may be used by

1999

$650,000

“persons in possession” of any property included in

2000 and 2001

$675,000

the decedent’s gross estate.

2002 and 2003

$1,000,000

Form DR-312 is admissible as evidence of nonliability

2004 and 2005

$1,500,000

for Florida estate tax and will remove the Department’s

estate tax lien. The Florida Department of Revenue will

2006, 2007 and 2008

$2,000,000

no longer issue Nontaxable Certificates for estates for

2009

$3,500,000

which the DR-312 has been duly filed and no federal

Form 706 or 706-NA is due.

2010

$0

2011 and 2012

$5,000,000

The 3-inch by 3-inch space in the upper right corner of

the form is for the exclusive use of the clerk of the court.

For thresholds for filing federal Form 706-NA

Do not write, mark, or stamp in that space.

(nonresident alien decedent), contact your local Internal

Where to File Form DR-312

Revenue Service office.

Form DR-312 must be recorded directly with the clerk

If an administration proceeding is pending for an estate,

of the circuit court in the county or counties where the

Form DR-312 may be filed in that proceeding. The case

decedent owned property. Do not send this form to the

style of the proceeding should be added in the large

Florida Department of Revenue.

blank space in the upper left portion of the DR-312.

When to Use Form DR-312

Form DR-312 should be filed with the clerk of the court

Form DR-312 should be used when an estate is not

and duly recorded in the public records of the county or

subject to Florida estate tax under Chapter 198, F.S.,

counties where the decedent owned property.

and a federal estate tax return (federal Form 706 or

706-NA) is not required to be filed. NOTE: This form

may NOT be used for estates that are required to file

federal form 706 or 706A.

For Information and Forms

Information and forms are available on our

For a written reply to tax questions, write:

Internet site at

Taxpayer Services Mail Stop 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32304-0112

To speak with a Department of Revenue

representative, call Taxpayer Services,

Reference Material

Monday through Friday, 8 a.m. to 7 p.m., ET,

Rule Chapter 12C-3, Florida Administrative

at 800-352-3671.

Code and Chapter 198, Florida Statutes. Tax

statutes and rules are available online at:

Persons with hearing or speech impairments

/law

may call the TDD at 800-367-8331 or

850-922-1115.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2