Form F-706 - Florida Estate Tax Return For Residents, Nonresidents, And Nonresident Aliens Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FORM F-706

F-706

R. 06/11

Page 2

General Information

authorized under state and federal law. Visit our Internet

site at and select “Privacy

Florida’s estate tax is based on the allowable federal credit

for state death taxes. Florida tax is imposed only on those

Notice” for more information regarding the state and

estates subject to federal estate tax filing requirements and

federal law governing the collection, use, or release of

SSNs, including authorized exceptions.

entitled to a credit for state death taxes (Chapter 198, F.S.).

Estate tax is not due if a federal estate tax return (Form 706

Where to File

or 706-NA) is not required to be filed. (When estate tax is not

Mail your completed F-706 and payment to:

due because there is no federal estate tax filing requirement,

Florida Department of Revenue

you should use Florida Form DR-312, Affidavit of No Florida

PO Box 6460

Estate Tax Due, to remove the Florida estate tax lien on the

Tallahassee, FL 32399-6460

property.) If a nontaxable certificate is requested, you must

If you are requesting a nontaxable certificate, include the

pay a $5.00 fee for it.

$5.00 fee.

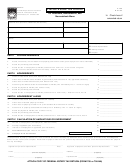

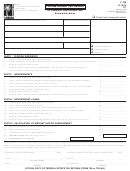

Form F-706 Filing Requirements

Signature

The requirement to file Form F-706 depends upon the date

The personal representative must sign the return

of death.

declaration under penalties of perjury. If someone else

prepares the return, the preparer must also sign the return.

Date of Death

F-706 Required?

Amending Form F-706

On or before December 31, 2004

Yes**

If you must change a return that has already been filed,

you must complete another Form F-706 and check

On or after January 1, 2005 –

No

the amended return box on the form. If the amended

December 31, 2012

return is caused by a change in your federal Form 706

On or after January 1, 2013

Yes**

or 706-NA, you must attach a statement describing the

reasons and all documents related to the change, including

**If required, Form F-706 must be filed for the estate of

correspondence received from the IRS and/or the amended

every Florida resident, nonresident, and nonresident alien

federal Form 706 or 706-NA.

with Florida property that is required to file a federal estate

Penalties and Interest

tax return (Form 706 or Form 706-NA). The personal

Penalties – If tax is not paid by the due date (or approved

representative must attach a signed copy of federal Form

extension date) a late payment penalty of 10% of the

706 or 706-NA to the Florida estate tax return.

unpaid tax is due. After 30 days, the late penalty increases

Due Dates and Extensions of Time

to 20%. An added penalty of 10% per month up to a

Form F-706 and payment is due within 9 months after the

maximum of 50% of the tax due is imposed if the unpaid

decedent’s death (when the federal estate tax return is

tax is due to negligence or intentional disregard. A fraud

due). If you need an extension of time to file or pay, you

penalty of 100% of the tax due is imposed if the unpaid tax

must send your request to the Internal Revenue Service

is due to willful intent to defraud. However, the Department

(IRS). Florida does not have a separate extension form.

of Revenue is authorized to compromise or settle these

We will grant the same extension to pay or file that the

penalties pursuant to section 213.21, F.S.

IRS does; however, you must send copies of both the

Interest – Interest is due on late payments from the due

extension request and approved federal extension to

date until paid. Interest rates are updated January 1 and

us within 30 days of mailing the request and 30 days of

July 1 of each year. To obtain current interest rates, visit

receiving the federal approval. An extension of time to file

our website at .

does not extend the time to pay. Interest accrues on the

Florida tax due from the original due date until paid.

Need Assistance?

Information and forms are available on our Internet site at

Tax Paid to Other States

.

For Florida residents: if estate, inheritance, or other death

taxes were properly paid to other states, proof of payment

To speak with a Department of Revenue representative,

must be submitted to the Florida Department of Revenue.

call Taxpayer Services, Monday through Friday, 8:00a.m.

(Proof of payment means the final certificate of payment

to 7 p.m., ET, at 800-352-3671. Persons with hearing or

showing the specific amounts of tax, penalty, or interest

speech impairments may call the TDD line at 800-367-8331

assessed and paid.)

or 850-922-1115.

*Social Security Numbers

For a written reply to your tax questions, write:

Social security numbers (SSNs) are used by the Florida

Taxpayer Services Mail Stop 3-2000

Department of Revenue as unique identifiers for the

Florida Department of Revenue

administration of Florida’s taxes. SSNs obtained for tax

5050 W Tennessee St

administration purposes are confidential under sections

Tallahassee, FL 32399-0112

213.053 and 119.071, Florida Statutes, and not subject

For federal estate tax information or forms, visit the IRS

to disclosure as public records. Collection of your SSN is

website at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2