return with the Internal Revenue Service if VT income is

Line 4b: Capital Gains Exclusion See Schedule FI-162 and

affected.

instructions to calculate the capital gains exclusion for 2013.

See Technical Bulletin 60 on our website under “Publications”.

FORM FOR AMENDING VT FIDUCIARY TAX RETURN

Schedule FI-162 is not included here. It may be downloaded at

•

Check the Amended box in the upper right-hand corner on

in the “Forms” section, or mailed to you by

the applicable tax year(s) Form FI-161.

calling (802) 828-2515.

NET OPERATING LOSSES No VT refund is available for a

Line 4c: Adjustment for Bonus Depreciation on Prior Year

carryback. The VT carryback or carryforward election for a net

Property Enter the difference between the depreciation calculated

operating loss must be the same as elected for Federal purposes.

by standard MACRS methods and the depreciation calculated at

the Federal level. For information on calculating the amount that

LINE-BY-LINE INSTRUCTIONS

can be subtracted from taxable income, see Technical Bulletin 44.

Line 1: Enter the taxable income amount from Federal Form

Line 5: Subtract Line 4d from Line 3.

1041, Line 22. For Qualified Settlement Funds, enter the amount

Line 6: Using Schedule B compute the tax on the VT taxable

from Federal Form 1120-SF.

income. Enter the tax from Line 23 or Line 25.

Line 2a: Enter the calculation of Non-VT State & Local

Line 7: Most taxpayers should enter 100% on this line. However,

Obligations from Schedule A, Line 18. For nonresident taxpayers,

a nonresident or part-year resident estate or trust should first

use Schedule E, Line 58 to adjust for Non-VT State and Local

complete Schedule E and then Schedule C to determine the income

Obligations.

adjustment.

Line 2b: Federal Bonus Depreciation VT does not recognize

the bonus depreciation allowed under Federal law for 2013. Enter

Line 9: Credit for Income Tax Paid to Other State or Canadian

Province (FOR FULL-YEAR AND SOME PART-YEAR

the difference between the depreciation calculated by standard

RESIDENT ESTATES & TRUSTS) Complete Schedule D and

MACRS methods and the depreciation calculated using the Federal

enter the amount here.

bonus depreciation for assets placed in service in 2013. Go to

“Publications” to see Technical Bulletin 44

Line 11a: From 1099, Statements of VT Income Tax Withheld,

for information on calculating the amount to add back to taxable

Estimated and/or Extension Payments. Enter the amount of VT

income.

income tax withheld. Attach the copy of the 1099 or other payment

statement(s) to verify the amount. Estimated payments are not

Line 2c: State and Local Income Taxes Enter the amount of

required to be made for trusts and estates. However, if you chose

state and local income taxes above $5,000 which are included on

Federal Form 1041, Line 11.

to make “estimated” payments, enter the amount paid and/or the

amount paid with the Extension of Time to File on this line as well.

Line 4a: Interest Income from U.S. Obligations

Interest

income from U.S. government obligations (such as U.S. Treasury

Line 11b: From Form RW-171, VT Real Estate Withholding.

If VT real estate was sold during 2013 and the buyer withheld VT

Bonds, Bills, and Notes) is exempt from VT tax under the laws of

the United States. Enter the amount of interest income from U.S.

income tax from the sales price, enter the amount withheld shown

on Form RW-171, Vermont Withholding Tax Return for Transfer

Obligations on this line.

of Real Property, Schedule A, Line 12 here.

Interest income is exempt when received directly from the U.S.

Installment sales - for information on installment sales, go

Treasury or from a trust, partnership, or mutual fund that invests

in direct obligations of the U.S. government.

to under “Publications” see Technical

Bulletin 10.

Income from the sale of U.S. government obligations is taxable

in VT. Income from repurchase agreements, securities of

Line 11c: From Form WH-435, Estimated Payment Made on

FNMA, FHMC or GNMA or other investments that are not direct

Behalf of a Trust or Estate by a Business Entity for Nonresident

Partner, Member or Shareholder. NONRESIDENTS enter the

obligations of the U.S. government are also taxable. See Technical

Bulletin 24 for more information.

estimated income tax payments made on behalf of the Trust or

Estate by a partnership, limited liability company, or S corporation

Supporting Documentation Required No attachment to return

toward the 2013 VT Fiduciary income tax. The entity would have

required. However, obtain statements for the taxpayer’s records

made these payments on Form WH-435. See Technical Bulletin 6.

in the event the Department requests such documentation.

Acceptable statements need to show the sources of U.S. government

SCHEDULE A

interest income and the percentage from each source. Summary

INTEREST AND DIVIDEND INCOME FROM NON-VT STATE

information from a K-1, or just a statement “U.S. government

AND LOCAL OBLIGATIONS ARE TAXABLE IN VT. A VT

securities” without further identification is not acceptable.

obligation is one from the State of VT or VT municipality.

NOTE: If U.S. interest is distributed on Line 18 of the Federal

Line 16: Enter the total interest and dividend income received

1041, the deduction is lost.

from all state and local obligations exempted from Federal tax.

You may not reduce interest and dividend income by investment

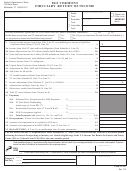

VT 2013 Tax Rate Schedule

expenses if those expenses are not used to reduce income on your

federal return.

If Taxable

of the

Line 17: Enter the interest and dividend income from VT

Income

But

the VT

amount

obligations. This may have been paid directly or through a

is Over

Not Over

Tax is

over

mutual fund or other legal entity that invests in VT state and

$0

$2,450

3.55%

$0

local obligations. If the income is received from a mutual fund

$2,450

$5,700

$87.00 + 6.80%

$2,450

that has only a portion of its assets invested in VT state and local

obligations, enter only the VT obligation amount.

$5,700

$8,750

$308.00 + 7.80%

$5,700

Line 18: Subtract Line 17 from Line 16. Enter result here and also

$8,750

$11,950

$546.00 + 8.80%

$8,750

on Line 2a. This is the amount of interest and dividend income

$11,950

---

$827.00 + 8.95%

$11,950

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8