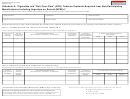

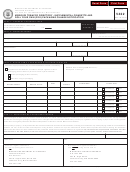

Instructions for Schedule K (Form 3669)

GENERAL INFORMATION

Line-by-Line Instructions

P.A. 244 of 1999 requires that manufacturer's of tobacco products who are not participating

Line 1: Enter your business name as it appears on your tobacco tax license.

in the Master Settlement Agreement, who sell cigarettes, including "Roll-Your-Own"

Line 2: Enter the address of where correspondence is to be mailed.

tobacco, within the state, either directly or through intermediaries, place funds into a

Line 3: Enter the name of the person to contact if there are questions regarding this form.

qualified escrow account.

Line 4: Enter the phone number of the contact person.

Line 5: Enter the Federal Identificaion, TR or ME number that appears on your tobacco tax

Sec. 1 (l) of Act 244 defines a tobacco product manufacturer as: "…an entity that after the

license.

date of enactment of this act directly (and not exclusively through an affiliate) meets 1 or

Line 6: Enter the return period that the schedule covers. A separate Schedule K must be

more of the following:

completed for each return period.

PART 1

(i) Manufactures cigarettes anywhere that such manufacturer intends to be sold in the United

States, including cigarettes intended to be sold in the United States through an importer

Cigarettes and RYO tobacco purchased/acquired must also be reported on Schedule A or F.

(except where such importer is an original participating manufacturer that will be responsible

File a separate schedule for each month.

for the payments under the master settlement agreement with respect to such cigarettes as a

result of the provisions of subsection II (mm) of the master settlement agreement and that

PART 2

pays the taxes specified in subsection II (z) of the master settlement agreement, and provided

Returns to the manufacturer and transfers to other states must also be reported on schedule C

that the manufacturer of such cigarettes does not market or advertise such cigarettes in the

(R) or C (T). File a separate schedule for each month.

United States).

(ii) Is the first purchaser anywhere for resale in the United States of cigarettes manufactured

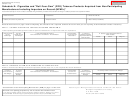

Line 7/13: Invoice Date. This must be the invoice date indicating when the cigarettes or

anywhere that the manufacturer does not intend to be sold in the United States.

roll-your-own were sold for delivery into or transferred from Michigan. Complete a separate

(iii) Becomes a successor of an entity described in subparagraph (i) or (ii)."

line for each invoice.

Line 8/14: Invoice Number. This must be the invoice number indicating when the cigarettes

The definition of 'cigarette' includes "Roll-Your-Own" tobacco.

or roll-your-own were sold for delivery into or transferred from Michigan. Complete a

separate line for each invoice.

The amount to be deposited in escrow is based upon the specified rate per unit sold. 'Units

sold' is measured by excise tax collected by the state on tobacco products manufactured by

Line 9/15: Non-Participating Manufacturer Name and Address. Enter the name and

the Non-Participating Manufacturer (NPM).

address of the non-participating manufacturer (NPM) who manufactured the cigarettes or

roll-your-own or, is the importer of record from outside the United States. You may visit the

P.A. 327 of 1993, the Tobacco Products Tax Act, requires that tax be remitted monthly for

website to learn which manufacturers are participating in the Master

tobacco products sold by licensed Wholesalers and Unclassified Acquirers to customers

Settlement Agreement and should not be included on Schedule K, or you may contact the

within this state. Data relating to cigarettes and "Roll-Your-Own" tobacco manufactured by

Tobacco Taxes Unit at (517) 636-4630 to determine if a manufacturer is an NPM including

NPM's must be obtained from licensed Wholesalers and Unclassified Acquirers.

and importer of record. The NPM's full name must be entered - Do Not Abbreviate. The

distributor of the cigarettes or roll-your-own is XYZ Distribution Co., however the NPM that

Sec. 7 (2) of Act 327 requires that monthly tax returns be accompanied by any information

manufactured or imported the cigarettes or roll-your-own tobacco from outside of the United

the department requires.

States is Worlds Best Tobacco. You must enter the name Worlds Best Tobacco.

Line 10/16: Brand Name. Enter the full brand name (Do Not Abbreviate) of the cigarettes or

Licensed Wholesalers and Unclassified Acquirers are required to attach to each monthly tax

roll-your-own tobacco. Complete a separate line for each brand on an invoice. If, however,

return a completed Schedule K to report all cigarette and "Roll-Your-Own" tobacco acquired

the brand name comes in a variety of types, such as Kings, 100's, etc., it is not necessary to

from NPM's during the month. The returns, with Schedule K attached, are to be filed on or

separate them.

before the 20th day of the month following the close of the reporting period.

Line 11/17: Number of cigarettes. Entries on all forms must be individual cigarettes, not

Schedule K must be filed even if there were no cigarettes or "Roll-Your-Own"

cases, cartons, or packs (For example, report 120,000 cigarettes, not 10 cases, 600 cartons or

tobacco products acquired from NPM's during the reporting period. Indicate

6,000 packs.)

"-0-" or "None" on the schedule.

Line 12/18: Roll-your-own tobacco. Use the appropriate column to report one of the

following: pounds, ounces, or kilograms of RYO tobacco.

1

1 2

2