Form It-App - Application For Approval Of Project Plan Manufacturer'S Investment Tax Credit

ADVERTISEMENT

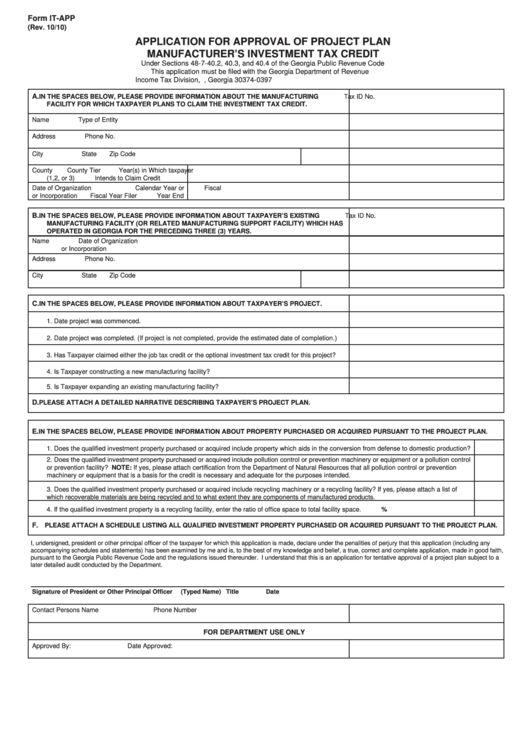

Form IT-APP

(Rev. 10/10)

APPLICATION FOR APPROVAL OF PROJECT PLAN

MANUFACTURER’S INVESTMENT TAX CREDIT

Under Sections 48-7-40.2, 40.3, and 40.4 of the Georgia Public Revenue Code

This application must be filed with the Georgia Department of Revenue

Income Tax Division, P.O. Box 740397 - Atlanta, Georgia 30374-0397

A.

IN THE SPACES BELOW, PLEASE PROVIDE INFORMATION ABOUT THE MANUFACTURING

Tax ID No.

FACILITY FOR WHICH TAXPAYER PLANS TO CLAIM THE INVESTMENT TAX CREDIT.

Name

Type of Entity

Address

Phone No.

City

State

Zip Code

County

County Tier

Year(s) in Which taxpayer

(1,2, or 3)

Intends to Claim Credit

Date of Organization

Calendar Year or

Fiscal

or Incorporation

Fiscal Year Filer

Year End

B.

IN THE SPACES BELOW, PLEASE PROVIDE INFORMATION ABOUT TAXPAYER’S EXISTING

Tax ID No.

MANUFACTURING FACILITY (OR RELATED MANUFACTURING SUPPORT FACILITY) WHICH HAS

OPERATED IN GEORGIA FOR THE PRECEDING THREE (3) YEARS.

Name

Date of Organization

or Incorporation

Address

Phone No.

City

State

Zip Code

C.

IN THE SPACES BELOW, PLEASE PROVIDE INFORMATION ABOUT TAXPAYER’S PROJECT.

1. Date project was commenced.

2. Date project was completed. (If project is not completed, provide the estimated date of completion.)

3. Has Taxpayer claimed either the job tax credit or the optional investment tax credit for this project?

4. Is Taxpayer constructing a new manufacturing facility?

5. Is Taxpayer expanding an existing manufacturing facility?

D.

PLEASE ATTACH A DETAILED NARRATIVE DESCRIBING TAXPAYER’S PROJECT PLAN.

E.

IN THE SPACES BELOW, PLEASE PROVIDE INFORMATION ABOUT PROPERTY PURCHASED OR ACQUIRED PURSUANT TO THE PROJECT PLAN.

1. Does the qualified investment property purchased or acquired include property which aids in the conversion from defense to domestic production?

2. Does the qualified investment property purchased or acquired include pollution control or prevention machinery or equipment or a pollution control

or prevention facility? NOTE: If yes, please attach certification from the Department of Natural Resources that all pollution control or prevention

machinery or equipment that is a basis for the credit is necessary and adequate for the purposes intended.

3. Does the qualified investment property purchased or acquired include recycling machinery or a recycling facility? If yes, please attach a list of

which recoverable materials are being recycled and to what extent they are components of manufactured products.

4. If the qualified investment property is a recycling facility, enter the ratio of office space to total facility space.

%

F.

PLEASE ATTACH A SCHEDULE LISTING ALL QUALIFIED INVESTMENT PROPERTY PURCHASED OR ACQUIRED PURSUANT TO THE PROJECT PLAN.

I, undersigned, president or other principal officer of the taxpayer for which this application is made, declare under the penalities of perjury that this application (including any

accompanying schedules and statements) has been examined by me and is, to the best of my knowledge and belief, a true, correct and complete application, made in good faith,

pursuant to the Georgia Public Revenue Code and the regulations issued thereunder. I understand that this is an application for tentative approval of a project plan subject to a

later detailed audit conducted by the Department.

Signature of President or Other Principal Officer

(Typed Name)

Title

Date

Contact Persons Name

Phone Number

FOR DEPARTMENT USE ONLY

Approved By:

Date Approved:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2