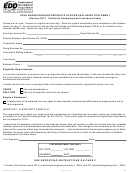

Oregon Revised Statute 657.044 Employment; service by partners and corporate officers and

directors who are family members excluded; exceptions.

(1) As used in this chapter, “employment” does not include service performed for:

(a) A corporation by corporate officers who are directors of the corporation, who have a substantial ownership interest

in the corporation and who are members of the same family if the corporation elects not to provide coverage for those

individuals. The election shall be in writing and shall be effective on the first day of the current calendar quarter or of the

calendar quarter preceding the calendar quarter in which the request was submitted.

(b) A limited liability company by a member, including members who are managers, as defined in ORS 63.001.

(c) A limited liability partnership by a partner as described in ORS chapter 67.

(2) The provisions of this section do not apply to service performed for:

(a) A nonprofit employing unit;

(b) This state;

(c) A political subdivision of this state; or

(d) An Indian tribe.

(3) As used in this section, “members of the same family” means persons who are members of a family as parents,

stepparents, grandparents, spouses, sons-in-law, daughters-in-law, brothers, sisters, children, stepchildren, adopted

children or grandchildren.

[1995 c.220 §2; 1997 c.646 §15; 1999 c.59 §195; 2001 c.572 §3; 2003 c.792 §1; 2005 c.218 §9; 2009 c.79 §1]

Oregon Administrative Rule 471-031-0017 Corporate Officer/Director Election

(1) For the purposes of ORS 657.044 an election not to provide coverage shall apply to all corporate officers who are

directors of the corporation, who have a substantial ownership interest in the corporation and who are members of the same

family.

(a) The term “substantial ownership” means total family ownership equal to or greater than seventy-five percent of the

corporation with each family member who is a corporate officer and director having ownership interest.

(b) The term “family” means two or more individuals related as parents, stepparents, grandparents, spouses, sons-in-law,

daughters-in-law, brothers, sisters, children, stepchildren, adopted children or grandchildren.

(c) The election not to provide coverage shall be in writing and shall be effective on the first day of the calendar quarter in

which the election was filed, or a later date when so specified in the election.

(2) The election is not effective unless approved by the Director of the Employment Department. The Director shall

mail a notice of approval or denial of the employing unit’s election to the last known address as shown in the

Employment Department’s records. Such notice shall become final 20 calendar days after notice is mailed unless within

such time the employing unit files with the Director, a request for a hearing with respect thereto.

(3) Hearings shall be conducted in accordance with the provisions of division 040 of OAR chapter 471.

(4) Judicial review of decisions issued pursuant to this rule shall be as provided for review of orders in contested cases

in ORS 183.310 through 183.550. The Director of the Employment Department is designated as a party for purposes of

hearings under this rule.

(5) Upon motion of the Director of the Employment Department or upon application of an interested employer, the Director

may in accordance with ORS 657.676 reconsider a notice issued pursuant to section (3) of this rule.

(6) A request for hearing on the denial of an employing unit’s election must be in writing and submitted by the employer

or the employer’s agent. The date of filing any request for hearing under this rule shall be determined in accordance with

provisions of OAR 471-010-0040.

(7) The employees listed in OAR 471-031-0145 and the Tax Section Supervisor of Status may act on behalf of the Director

for the purposes of sections (2) and (5) of this rule.

(8) An employing unit which has elected not to provide coverage may elect coverage under ORS 657.425.

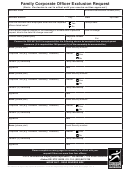

For more on the Corporate Officer Exemption, please refer to our Quick Tax Informational Flyer.

QUESTIONS

If you have questions or need additional information, please contact the Employment Department tax representative in your

area or call 503-947-1488; TDD/Nonvoice Users 711 or by email at taxinfo@emp.state.or.us. You may also visit our website

at

PREGUNTAS

Si tiene preguntas o necesita información adicional, por favor comuníquese con el representante impositivo del

Departamento de Empleo de su área, o llama al 503-947-1488; usuarios TDD/Hipoacúsicos al 711 o por correo electrónico

a taxinfo@emp.state.or.us. También puede visitar nuestro sitio de web en

WorkSource Oregon Employment Department is an equal opportunity employer/program. Auxiliary aids and services, alternate

formats and language services are available to individuals with disabilities and limited English proficiency free of cost upon request.

WorkSource Oregon Departamento de Empleo es un programa que respeta la igualdad de oportunidades.

Disponemos de servicios o ayudas auxiliares, formatos alternos y asistencia de idiomas para personas

con discapacidades o conocimiento limitado del inglés, a pedido y sin costo.

WorkSource Oregon Employment Department • • Form 2578 (0111) page 2 of 2

1

1 2

2