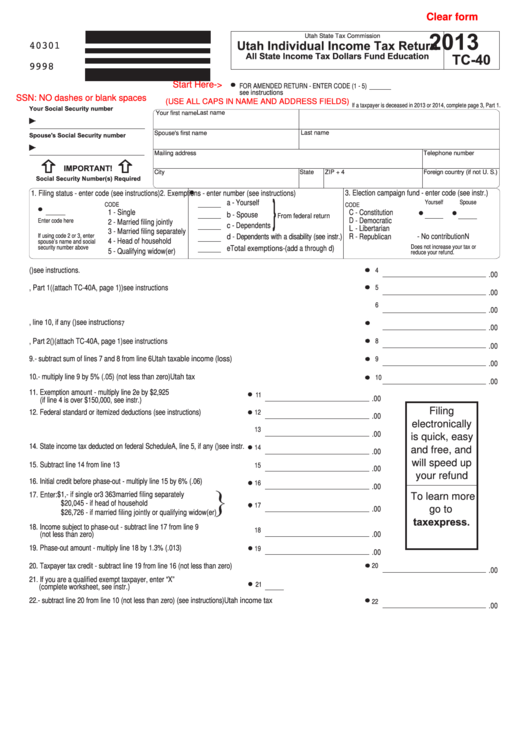

Clear form

Utah State Tax Commission

2013

40301

Utah Individual Income Tax Return

All State Income Tax Dollars Fund Education

TC-40

incometax.utah.gov

9998

Start Here->

FOR AMENDED RETURN - ENTER CODE (1 - 5)

see instructions

SSN: NO dashes or blank spaces

(USE ALL CAPS IN NAME AND ADDRESS FIELDS)

If a taxpayer is deceased in 2013 or 2014, complete page 3, Part 1.

Your Social Security number

Last name

Your first name

Spouse's first name

Last name

Spouse's Social Security number

Mailing address

Telephone number

IMPORTANT!

City

Foreign country (if not U. S.)

State

ZIP + 4

Social Security Number(s) Required

1. Filing status - enter code (see instructions)

2. Exemptions - enter number (see instructions)

3. Election campaign fund - enter code (see instr.)

}

a - Yourself

Yourself

Spouse

CODE

CODE

1 - Single

C

- Constitution

b - Spouse

From federal return

D

- Democratic

Enter code here

2 - Married filing jointly

c - Dependents

L

- Libertarian

3 - Married filing separately

If using code 2 or 3, enter

R

- Republican

N

- No contribution

d - Dependents with a disability (see instr.)

4 - Head of household

spouse’s name and social

Does not increase your tax or

security number above

e Total exemptions

-

(add a through d)

5 - Qualifying widow(er)

reduce your refund.

4. Federal adjusted gross income from federal return (

see instructions.

)

4

.00

5. Additions to income from TC-40A, Part 1

(attach TC-40A, page 1)

(

see instructions

)

5

.00

6. Total income - add line 4 and line 5

6

.00

7. State tax refund included on federal form 1040, line 10, if any (

see instructions

)

7

.00

8. Subtractions from income from TC-40A, Part 2

(attach TC-40A, page 1) see instructions

(

)

8

.00

9.

Utah taxable income (loss)

- subtract sum of lines 7 and 8 from line 6

9

.00

10.

Utah tax

- multiply line 9 by 5% (.05) (not less than zero)

10

.00

11. Exemption amount - multiply line 2e by $2,925

11

.00

(if line 4 is over $150,000, see instr.)

Filing

12. Federal standard or itemized deductions (see instructions)

12

.00

electronically

13. Add line 11 and line 12

13

.00

is quick, easy

14. State income tax deducted on federal Schedule A, line 5, if any (

see instr.

)

14

and free, and

.00

will speed up

15. Subtract line 14 from line 13

15

.00

your refund

16. Initial credit before phase-out - multiply line 15 by 6% (.06)

16

.00

17. Enter: $1 ,

3 363

- if single or

married filing separately

To learn more

$20,045 - if head of household

17

go to

.00

$26,726 - if married filing jointly or qualifying widow(er)

taxexpress.

18. Income subject to phase-out - subtract line 17 from line 9

18

(not less than zero)

.00

utah.gov

19. Phase-out amount - multiply line 18 by 1.3% (.013)

19

.00

20. Taxpayer tax credit - subtract line 19 from line 16 (not less than zero)

20

.00

21. If you are a qualified exempt taxpayer, enter “X”

21

(complete worksheet, see instr.)

22.

Utah income tax

- subtract line 20 from line 10 (not less than zero) (see instructions)

22

.00

1

1 2

2 3

3 4

4 5

5 6

6 7

7