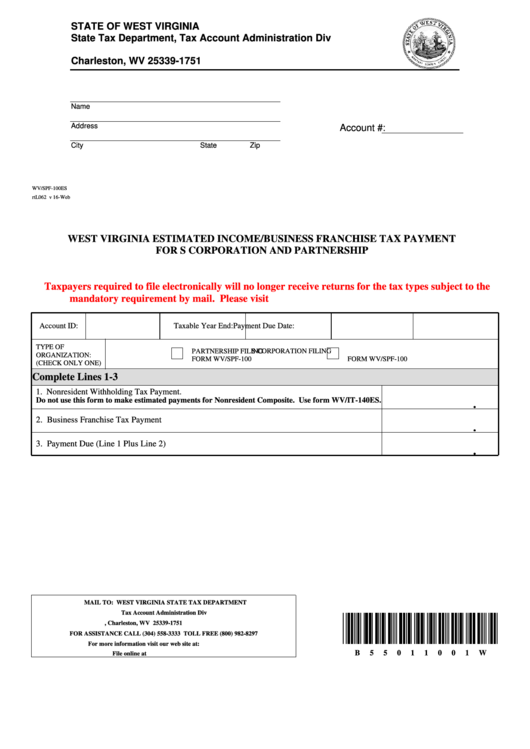

Form Wv/spf-100es - West Virginia Estimated Income/business Franchise Tax Payment For S Corporation And Partnership

ADVERTISEMENT

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 11751

Charleston, WV 25339-1751

Name

Address

Account #:

City

State

Zip

WV/SPF-100ES

rtL062 v 16-Web

WEST VIRGINIA ESTIMATED INCOME/BUSINESS FRANCHISE TAX PAYMENT

FOR S CORPORATION AND PARTNERSHIP

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the

mandatory requirement by mail. Please visit for additional information.

Account ID:

Taxable Year End:

Payment Due Date:

TYPE OF

PARTNERSHIP FILING

S CORPORATION FILING

ORGANIZATION:

FORM WV/SPF-100

FORM WV/SPF-100

(CHECK ONLY ONE)

Complete Lines 1-3

1. Nonresident Withholding Tax Payment.

Do not use this form to make estimated payments for Nonresident Composite. Use form WV/IT-140ES.

.

2. Business Franchise Tax Payment

.

3. Payment Due (Line 1 Plus Line 2)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 11751, Charleston, WV 25339-1751

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

B

5

5

0

1

1

0

0

1

W

File online at https://mytaxes.wvtax.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2