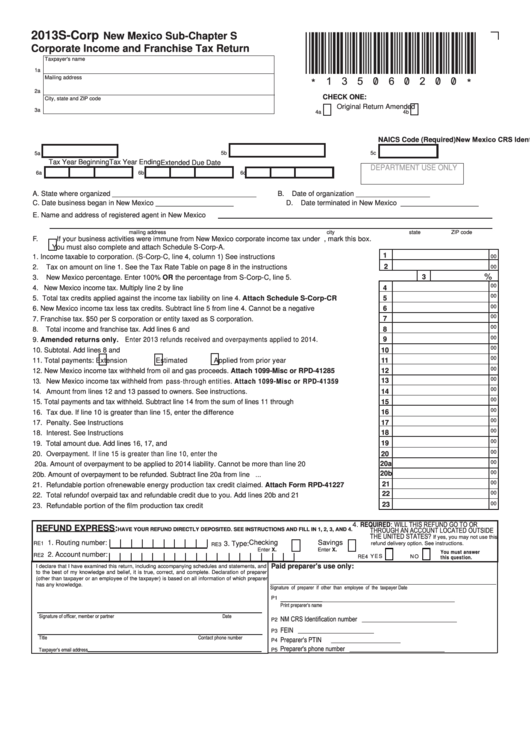

Form S-Corp - New Mexico Sub-Chapter S Corporate Income And Franchise Tax Return - 2013

ADVERTISEMENT

2013 S-Corp

New Mexico Sub-Chapter S

*135060200*

Corporate Income and Franchise Tax Return

Taxpayer's name

1a

Mailing address

2a

CHECK ONE:

City, state and ZIP code

Original Return

Amended

3a

4a

4b

Federal Employer Identification No. (Required)

New Mexico CRS Identification No.

NAICS Code (Required)

5a

5b

5c

Tax Year Beginning

Tax Year Ending

Extended Due Date

DEPARTMENT USE ONLY

6a

6b

6c

A.

State where organized _____________________________________

B.

Date of organization ___________________

C.

Date business began in New Mexico ___________________ _

D.

Date terminated in New Mexico ___________________ _

E.

Name and address of registered agent in New Mexico

mailing address

city

state

ZIP code

F.

If your business activities were immune from New Mexico corporate income tax under P.L. 86-272 for the 2013 tax year, mark this box.

You must also complete and attach Schedule S-Corp-A.

1

1.

Income taxable to corporation. (S-Corp-C, line 4, column 1) See instructions .............................................

00

2

2.

Tax on amount on line 1. See the Tax Rate Table on page 8 in the instructions ...........................................

00

%

3

3.

New Mexico percentage. Enter 100% OR the percentage from S-Corp-C, line 5. .......................................

00

4.

New Mexico income tax. Multiply line 2 by line 3...............................................................................................

4

00

5.

Total tax credits applied against the income tax liability on line 4. Attach Schedule S-Corp-CR ..............

5

00

6

6.

New Mexico income tax less tax credits. Subtract line 5 from line 4. Cannot be a negative number............

00

7

7.

Franchise tax. $50 per S corporation or entity taxed as S corporation. ........................................................

00

8.

Total income and franchise tax. Add lines 6 and 7.............................................................................................

8

00

9

9.

Amended returns only. Enter 2013 refunds received and overpayments applied to 2014. ..............................

00

10. Subtotal. Add lines 8 and 9..................................................................................................................................

10

00

11. Total payments:

Extension

Estimated

Applied from prior year ......................................

11

00

12. New Mexico income tax withheld from oil and gas proceeds. Attach 1099-Misc or RPD-41285 ...............

12

00

13

13. New Mexico income tax withheld from pass-through entities. Attach 1099-Misc or RPD- 41359 ...............

00

14. Amount from lines 12 and 13 passed to owners. See instructions. .................................................................

14

00

15. Total payments and tax withheld. Subtract line 14 from the sum of lines 11 through 13................................

15

00

16

16. Tax due. If line 10 is greater than line 15, enter the difference ......................................................................

00

17

17. Penalty. See Instructions ................................................................................................................................

00

18

18. Interest. See Instructions ................................................................................................................................

00

19

19. Total amount due. Add lines 16, 17, and 18........................................................................................................

00

20. Overpayment. If line 15 is greater than line 10, enter the difference...............................................................

20

00

20a

20a. Amount of overpayment to be applied to 2014 liability. Cannot be more than line 20 ...........................

00

20b

20b. Amount of overpayment to be refunded. Subtract line 20a from line 20.............................................. ...

00

21

21. Refundable portion of renewable energy production tax credit claimed. Attach Form RPD-41227 ............

00

22

22. Total refund of overpaid tax and refundable credit due to you. Add lines 20b and 21 ...................................

23. Refundable portion of the film production tax credit ........................................................................................

00

23

4. REQUIRED: WILL THIS REFUND GO TO OR

REFUND EXPRESS:

THROUGH AN ACCOUNT LOCATED OUTSIDE

HAVE YOUR REFUND DIRECTLY DEPOSITED. SEE INSTRUCTIONS AND FILL IN 1, 2, 3, AND 4.

THE UNITED STATES?

If yes, you may not use this

1. Routing number:

Checking

Savings

RE1

3. Type:

refund delivery option. See instructions.

RE3

Enter X.

Enter X.

You must answer

2. Account number:

RE2

this question.

Y E S

RE4

N O

Paid preparer's use only:

I declare that I have examined this return, including accompanying schedules and statements, and

to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer

(other than taxpayer or an employee of the taxpayer) is based on all information of which preparer

has any knowledge.

Signature of preparer if other than employee of the taxpayer

Date

_______________

P1

Print preparer's name

Signature of officer, member or partner

Date

NM CRS Identification number ______________________________

P2

FEIN ________________________

P3

Title

Contact phone number

Preparer's PTIN

______________________

P4

Preparer's phone number ______________________________

Taxpayer's email address

P5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3