Column (c ) – Taxable year assigned credit

Column (f) – Assigned credit received in �0��

• Form 100S Corporation Tax Booklet,

was generated. Enter the taxable year that the

taxable year. Enter the assigned credit amount

General Information BB, Tax Credits and

assignor originally generated the credit (form

that the assignee received from the assignor

specific line instructions for tax credits.

FTB 3544, Election to Assign Credit Within

during this taxable year (2012 form FTB 3544,

Total the amounts in column (i).

Combined Reporting Group, column (d)).

column (g)).

Note: The total amount of specific credit

For example, the assignor (Corporation A)

Column (g) – Assigned credit carryover

claimed on the Form 100, Form 100S,

generated a Research and Development (R&D)

from prior years. Enter the assigned credit

Form 100W, Schedule P (100), Schedule P

credit of $1,000 during the 2006 taxable year.

carryover amount from prior years.

(100W), or Schedule C (100S) should include

The credit was not claimed by Corporation A

Column (h) – Assigned credit available. Add

both: (1) the total assigned credit claimed

and was carried forward to the succeeding

the amounts on column (f) and column (g).

from column (i), and (2) the amount of credit

years. Corporation A assigned the available

Enter the result in column (h). Also, total the

claimed that was generated by the assignee.

credit to Corporation F (another unitary

amounts in column (h). This is the available

Column (j) – Carryover to future years.

member of the combined reporting group) in

assigned credit that the assignee can claim this

Subtract column (i) from column (h) and enter

the 2012 taxable year. Corporation F will enter

taxable year.

the result in column (j). If the assigned credit

“2006” as the taxable year the R&D credit was

Column (i) – Assigned credit claimed in

expires by the end of the current taxable year,

generated.

�0�� taxable year. This is the assigned

no carryover of assigned credit is allowed.

Column (d) – Taxable year assigned credit

credit amount that the assignee claimed in

Enter “0” in this column.

was received. Enter the taxable year that the

the current taxable year after specific credit

Total the amounts in column (j). This is the

assignee received the assigned credit from the

limitations. See General Information B,

total assigned credit carryover to future years.

assignor.

Disclosure of Limitations and Restrictions, for

Column (e) – Initial assigned credit amount

more information.

received. Enter the initial assigned credit

To figure the amount of assigned credit to

amount received from the assignor (use the

claim in the current taxable year, refer to the

applicable form FTB 3544, column (g)).

following:

• Form 100 or Form 100W Corporation Tax

Booklets, specific line instructions for tax

credits.

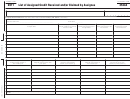

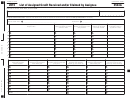

EXAMPLE – How to report the assigned credit received and/or claimed.

An assignor (Corporation A) generated an R&D credit of $20,000 in 2006 taxable year. Corporation A assigned to an assignee (Corporation B) an R&D

credit of $10,000 in 2009 taxable year and $3,000 in 2012 taxable year. Also, Corporation A generated an R&D credit of $8,000 in 2012 taxable year and

assigned $5,000 to Corporation B in the same taxable year. Assuming Corporation B can only claim assigned credit of $3,500 in 2012 taxable year and

$6,000 in 2013 taxable year, Corporation B should report each assigned credit transaction received and/or claimed separately as follows:

TAXABLE YEAR

2012

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

Taxable year

Taxable year

Initial assigned

Assigned credit

Assigned credit

Assigned credit

Assigned credit

Carryover to future

assigned credit was

assigned credit was

credit amount

received in 2012

carryover from

available column (f)

claimed in 2012

years column (h)

generated

received

received

taxable year

prior years

plus column (g)

taxable year

minus column (i)

2006

2009

10,000

0

10,000

10,000

500

9,500

2006

2012

3,000

3,000

0

3,000

3,000

0

2012

2012

5,000

5,000

0

5,000

0

5,000

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18,000

3,500

14,500

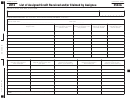

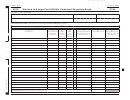

TAXABLE YEAR

2013

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

Taxable year

Taxable year

Initial assigned

Assigned credit

Assigned credit

Assigned credit

Assigned credit

Carryover to future

assigned credit was

assigned credit was

credit amount

received in 2013

carryover from

available column (f)

claimed in 2013

years column (h)

generated

received

received

taxable year

prior years

plus column (g)

taxable year

minus column (i)

2006

2009

10,000

0

9,500

9,500

6,000

3,500

2012

2012

5,000

0

5,000

5,000

0

5,000

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14,500

6,000

8,500

Page � FTB 3544A Instructions 2012

1

1 2

2 3

3