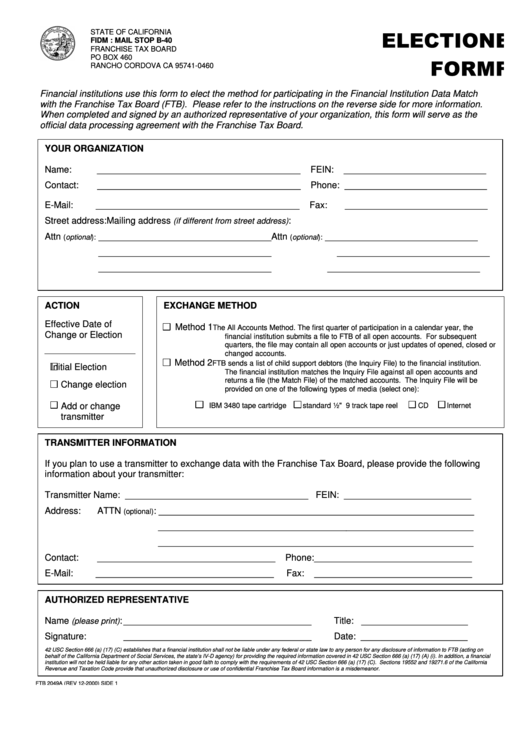

Form Ftb 2049a - Election Form

ADVERTISEMENT

ELECTION

ELECTION

STATE OF CALIFORNIA

FIDM : MAIL STOP B-40

FRANCHISE TAX BOARD

FORM

FORM

PO BOX 460

RANCHO CORDOVA CA 95741-0460

Financial institutions use this form to elect the method for participating in the Financial Institution Data Match

with the Franchise Tax Board (FTB). Please refer to the instructions on the reverse side for more information.

When completed and signed by an authorized representative of your organization, this form will serve as the

official data processing agreement with the Franchise Tax Board.

YOUR ORGANIZATION

Name:

________________________________________

FEIN:

____________________________

Contact:

________________________________________

Phone: ____________________________

E-Mail:

________________________________________

Fax:

____________________________

Street address:

Mailing address

:

(if different from street address)

Attn

__________________________________

Attn

______________________________

(optional):

(optional):

__________________________________

______________________________

__________________________________

______________________________

ACTION

EXCHANGE METHOD

Effective Date of

Method 1

The All Accounts Method. The first quarter of participation in a calendar year, the

Change or Election

financial institution submits a file to FTB of all open accounts. For subsequent

quarters, the file may contain all open accounts or just updates of opened, closed or

changed accounts.

Method 2

FTB sends a list of child support debtors (the Inquiry File) to the financial institution.

Initial Election

The financial institution matches the Inquiry File against all open accounts and

returns a file (the Match File) of the matched accounts. The Inquiry File will be

Change election

provided on one of the following types of media (select one):

Add or change

IBM 3480 tape cartridge

standard ½" 9 track tape reel

CD

Internet

transmitter

TRANSMITTER INFORMATION

If you plan to use a transmitter to exchange data with the Franchise Tax Board, please provide the following

information about your transmitter:

Transmitter Name: ____________________________________ FEIN: _________________________

Address:

ATTN

: ______________________________________________________________

(optional)

______________________________________________________________

______________________________________________________________

Contact:

___________________________________

Phone:_______________________________

E-Mail:

___________________________________

Fax:

_______________________________

AUTHORIZED REPRESENTATIVE

Name

: _____________________________________

Title: _____________________

(please print)

Signature:

_____________________________________

Date: _____________________

42 USC Section 666 (a) (17) (C) establishes that a financial institution shall not be liable under any federal or state law to any person for any disclosure of information to FTB (acting on

behalf of the California Department of Social Services, the state’s IV-D agency) for providing the required information covered in 42 USC Section 666 (a) (17) (A) (i). In addition, a financial

institution will not be held liable for any other action taken in good faith to comply with the requirements of 42 USC Section 666 (a) (17) (C). Sections 19552 and 19271.6 of the California

Revenue and Taxation Code provide that unauthorized disclosure or use of confidential Franchise Tax Board information is a misdemeanor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1