Sc Sch.tc-45 - Apprenticeship Credit

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

SC SCH.TC-45

DEPARTMENT OF REVENUE

APPRENTICESHIP CREDIT

(Rev. 12/5/07)

3441

Attach to your Income Tax Return

20

Name As Shown On Tax Return

SS No. or Fed. EI No.

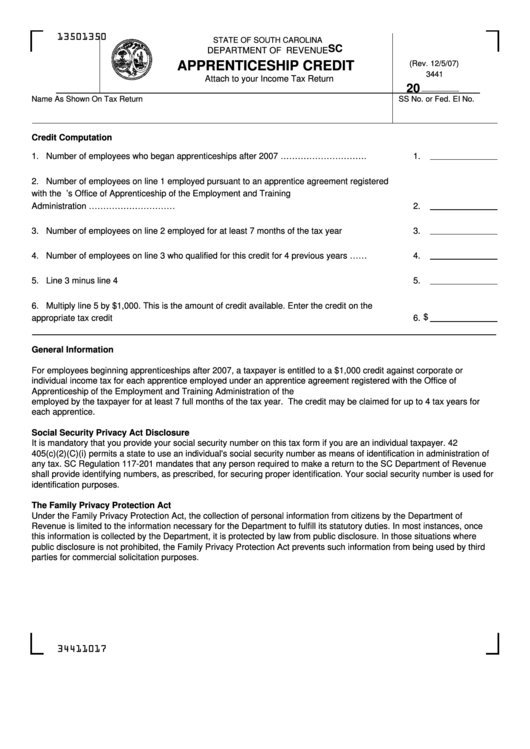

Credit Computation

1. Number of employees who began apprenticeships after 2007 ………………………….................

1.

2. Number of employees on line 1 employed pursuant to an apprentice agreement registered

with the U.S. Department of Labor’s Office of Apprenticeship of the Employment and Training

Administration …………………………...........................................................................................

2.

3. Number of employees on line 2 employed for at least 7 months of the tax year ..........................

3.

4. Number of employees on line 3 who qualified for this credit for 4 previous years …….................

4.

5. Line 3 minus line 4 .......................................................................................................................

5.

6. Multiply line 5 by $1,000. This is the amount of credit available. Enter the credit on the

$

appropriate tax credit schedule.....................................................................................................

6.

General Information

For employees beginning apprenticeships after 2007, a taxpayer is entitled to a $1,000 credit against corporate or

individual income tax for each apprentice employed under an apprentice agreement registered with the Office of

Apprenticeship of the Employment and Training Administration of the U.S. Department of Labor. The apprentice must be

employed by the taxpayer for at least 7 full months of the tax year. The credit may be claimed for up to 4 tax years for

each apprentice.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C

405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of

any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC Department of Revenue

shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used for

identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

34411017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1