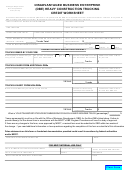

Form Drws - Disaster Relief Data Collection Worksheet Page 2

ADVERTISEMENT

Disaster Relief Data Collection Form

Instructions for Use

1. This data collection form (DRWS) and the associated MODIV coding will provide a

tracking tool to estimate losses to ratable bases due to Superstorm Sandy.

2. Use of this form is limited to data collection for assessment reductions due to real

property damage caused by Superstorm Sandy. All material depreciation as a result

of Sandy must be reflected on the 2013 tax list by use of this form and the associated

codes. Photographic support must be included.

3. Special MODIV Tax Codes are designated for affected improvement and external

land valuation scenarios. The designations serve as guidelines to ensure all property

owners are treated fairly and uniformly within your town/county.

4. Codes must be entered in the Special Tax Code Fields of MODIV. The percentage

associated with the selected code is automatically reduced except when using H86.

MODIV vendors are making the needed accommodations to effect the automatic

assessment reduction.

5. H86 should only be used when there is no damage to the principal structure, but to

accessory structures. Examples (Detached structures – sheds, garages, docks,

bulkhead damage). When H86 is used, there is no automatic % reduction to

improvement assessment. Assessors must adjust assessments of accessory

structures in CAMA manually. H86 must be entered in MODIV to indicate an

assessment reduction was made as a result of Sandy.

Resources to assist in identifying affected properties: FEMA, Code Enforcement, Construction

Officials, EMS, Public Safety Officials, etc.

Questions regarding the use of this form should be directed to your County Tax

Administrator or the Division of Taxation.

Questions regarding MODIV entry should be directed to your MODIV vendor or to Nichole

Carthan, LPT Information Services at 609-633-3721, Nichole.Carthan@treas.state.nj.us.

N.J.S.A 54:4-35.1 Material depreciation of structure between October 1 and January 1; determination of

-

value

When any parcel of real property contains any building or other structure which has been destroyed,

consumed by fire, demolished, or altered in such a way that its value has materially depreciated, either intentionally

or by the action of storm, fire, cyclone, tornado, or earthquake, or other casualty, which depreciation of value

occurred after October first in any year and before January first of the following year, the assessor shall, upon notice

thereof being given to him by the property owner prior to January tenth of said year, and after examination and

inquiry, determine the value of such parcel of real property as of said January first, and assess the same according

to such value.

.

NOTE: As improvements are repaired or rebuilt, added assessments must be applied

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2