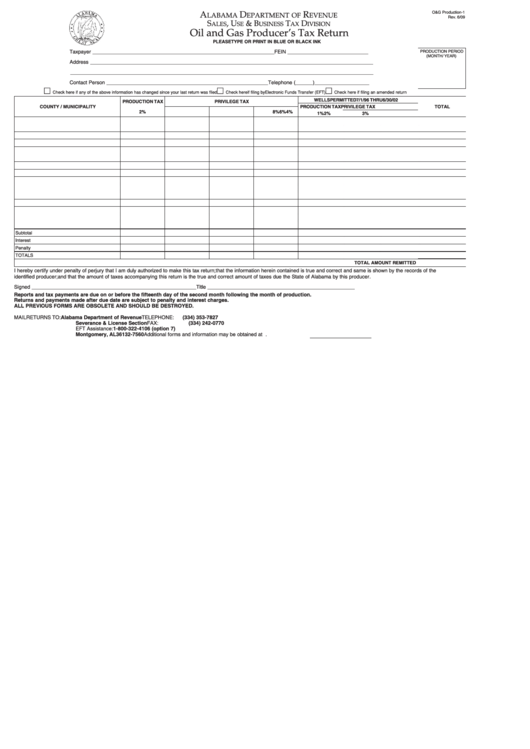

A

D

R

O&G Production-1

LABAMA

EPARTMENT OF

EVENUE

Rev. 6/09

Reset

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

Oil and Gas Producer’s Tax Return

PLEASE TYPE OR PRINT IN BLUE OR BLACK INK

Taxpayer _______________________________________________________________ FEIN ____________________________

PRODUCTION PERIOD

(MONTH / YEAR)

Address __________________________________________________________________________________________________

_________________________________________________________________________________________________________

Contact Person ________________________________________________________ Telephone (______)___________________

Check here if any of the above information has changed since your last return was filed

Check here if filing by Electronic Funds Transfer (EFT)

Check here if filing an amended return

WELLS PERMITTED 7/1/96 THRU 6/30/02

PRODUCTION TAX

PRIVILEGE TAX

COUNTY / MUNICIPALITY

PRODUCTION TAX

PRIVILEGE TAX

TOTAL

2%

4%

6%

8%

1%

2%

3%

Subtotal

Interest

Penalty

TOTALS

TOTAL AMOUNT REMITTED

I hereby certify under penalty of perjury that I am duly authorized to make this tax return; that the information herein contained is true and correct and same is shown by the records of the

identified producer; and that the amount of taxes accompanying this return is the true and correct amount of taxes due the State of Alabama by this producer.

Signed _________________________________________________________

Title ___________________________________________________

Reports and tax payments are due on or before the fifteenth day of the second month following the month of production.

Returns and payments made after due date are subject to penalty and interest charges.

ALL PREVIOUS FORMS ARE OBSOLETE AND SHOULD BE DESTROYED.

MAIL RETURNS TO:

Alabama Department of Revenue

TELEPHONE:

(334) 353-7827

Severance & License Section

FAX:

(334) 242-0770

P.O. Box 327560

EFT Assistance: 1-800-322-4106 (option 7)

Montgomery, AL 36132-7560

Additional forms and information may be obtained at

1

1 2

2