FORM

INSTRUCTIONS

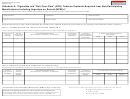

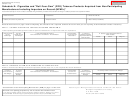

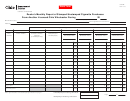

608-3

WHOLESALER’S MONTHLY REPORT OF MARYLAND STAMPED

CIGARETTES AND/OR MARYLAND SALES OF ROLL-YOUR-OWN

(RYO) TOBACCO ON WHICH THE TOBACCO TAX HAS BEEN PAID

Who must file this form?

Licensed cigarette wholesalers and roll-your-own tobacco wholesalers.

When must this form be filed?

No later than 21 days after the end of each calendar month.

What must be reported on this form?

Licensed wholesalers must provide the following information “by manufacturer and brand family.”

(1) Total number of cigarette packs affixed with a Maryland tax stamp during the calendar month;

(2) Total number of RYO equivalent stick count for roll-your-own tobacco sold in Maryland on which the tobacco tax has been paid during the calendar

month.

What is “Equivalent Stick Count”?

For purpose of determining the equivalent stick count, 0.09 ounces of roll-your-own tobacco is considered the same as one cigarette as defined by Md. Code Ann. Bus. Reg 16-

402(e)(2).

Completing this Form:

USE A SEPARATE FORM FOR EACH MANUFACTURER

In the spaces provided, enter the manufacturer’s name and address, the entity from whom you purchased the product, and the first importer, if the product is

foreign manufactured. From the information provided on invoices, purchase agreements, packaging or labeling material, and shipping documents, identify the manufacturer,

seller, and first importer, where applicable, for each brand family.

Column(s)

Line(s)

A

1-10

For each brand of cigarettes or roll-your-own tobacco, enter the Brand Family name as found on the Attorney General’s website:

md.us.

B

1-10

For each cigarette Brand Family, enter the number of packs stamped with a Maryland tax stamp according to pack size (packs of 20 and/or packs of

25.)

C

1-10

For each RYO Brand Family, enter the equivalent stick count using a factor of 0.09 ounces per stick for RYO sold in Maryland on which the tobacco tax

has been paid. (RYO quantity in ounces divided by 0.09 equals the equivalent stick count.) For RYO, each equivalent stick is considered a cigarette.

B-C

11

Provide a grand total for each column. If multiple forms are used for one manufacturer, enter only one grand total on the last line of the last form for

that manufacturer. Under Column B, total the number of packs of 20 and the number of packs of 25. Under Column C, total the equivalent stick count

on which tobacco taxes have been paid to the Comptroller of Maryland RYO sales.

Notes: (1) Roll-Your-Own (RYO) Tobacco must be reported on this form as indicated. DO NOT include any other type of “other tobacco products,” such as moist snuff, cigars, or

pipe tobacco.

(2) The supporting material and records used to complete this form, including MSAI data, must be retained for five (5) years from the due date, or filing date of this

report, whichever is later.

For more information:

Visit our Web site at or call Taxpayer Service at 410-260-7980 in Central Maryland or 1-800-638-2937 from elsewhere. Send faxes to 410-260-7924.

Mail to: Comptroller of Maryland, Revenue Administration Division, P.O. Box 2999, Annapolis, MD 21404-2999.

COM/RAD-608-3

Revised 02/13

1

1 2

2