Form Sc1040 - Individual Income Tax Return - 2013

ADVERTISEMENT

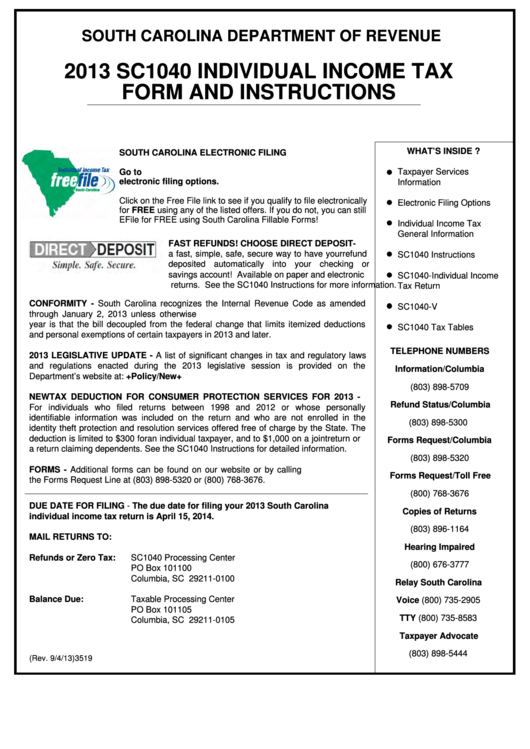

SOUTH CAROLINA DEPARTMENT OF REVENUE

2013 SC1040 INDIVIDUAL INCOME TAX

FORM AND INSTRUCTIONS

WHAT’S INSIDE ?

SOUTH CAROLINA ELECTRONIC FILING

Taxpayer Services

Go to to check out Free File and other

electronic filing options.

Information

Click on the Free File link to see if you qualify to file electronically

Electronic Filing Options

for FREE using any of the listed offers. If you do not, you can still

EFile for FREE using South Carolina Fillable Forms!

Individual Income Tax

General Information

FAST REFUNDS! CHOOSE DIRECT DEPOSIT-

a fast, simple, safe, secure way to have your refund

SC1040 Instructions

deposited automatically into your checking or

savings account! Available on paper and electronic

SC1040-Individual Income

returns. See the SC1040 Instructions for more information.

Tax Return

CONFORMITY - South Carolina recognizes the Internal Revenue Code as amended

SC1040-V

through January 2, 2013 unless otherwise provided. The highlight of conformity this

year is that the bill decoupled from the federal change that limits itemized deductions

SC1040 Tax Tables

and personal exemptions of certain taxpayers in 2013 and later.

TELEPHONE NUMBERS

2013 LEGISLATIVE UPDATE - A list of significant changes in tax and regulatory laws

and regulations enacted during the 2013 legislative session is provided on the

Information/Columbia

Department’s website at: /Tax+Policy/New+Legislation.htm

(803) 898-5709

NEW TAX DEDUCTION FOR CONSUMER PROTECTION SERVICES FOR 2013 -

Refund Status/Columbia

For individuals who filed returns between 1998 and 2012 or whose personally

identifiable information was included on the return and who are not enrolled in the

(803) 898-5300

identity theft protection and resolution services offered free of charge by the State. The

deduction is limited to $300 for an individual taxpayer, and to $1,000 on a joint return or

Forms Request/Columbia

a return claiming dependents. See the SC1040 Instructions for detailed information.

(803) 898-5320

FORMS - Additional forms can be found on our website or by calling

Forms Request/Toll Free

the Forms Request Line at (803) 898-5320 or (800) 768-3676.

(800) 768-3676

DUE DATE FOR FILING - The due date for filing your 2013 South Carolina

Copies of Returns

individual income tax return is April 15, 2014.

(803) 896-1164

MAIL RETURNS TO:

Hearing Impaired

Refunds or Zero Tax:

SC1040 Processing Center

(800) 676-3777

PO Box 101100

Columbia, SC 29211-0100

Relay South Carolina

Balance Due:

Taxable Processing Center

Voice (800) 735-2905

PO Box 101105

TTY (800) 735-8583

Columbia, SC 29211-0105

Taxpayer Advocate

(803) 898-5444

(Rev. 9/4/13) 3519

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28