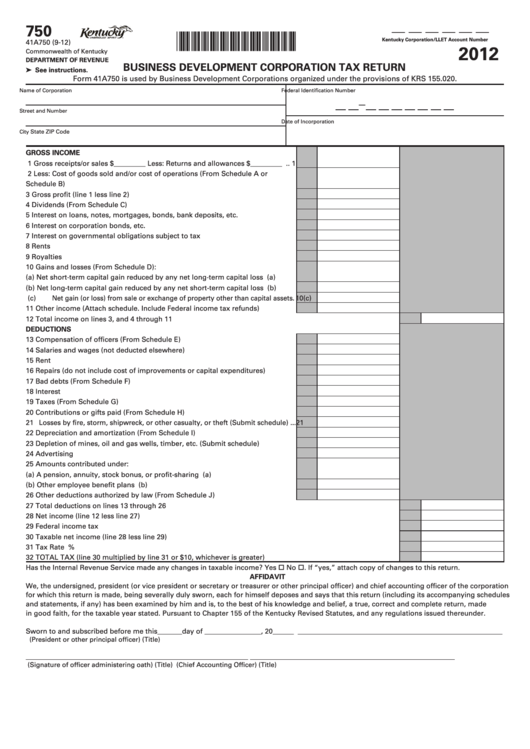

Form 750 - Business Development Corporation Tax Return - 2012

ADVERTISEMENT

__ __ __ __ __ __

750

*1200020302*

Kentucky Corporation/LLET Account Number

41A750 (9-12)

2012

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

BUSINESS DEVELOPMENT CORPORATION TAX RETURN

➤ See instructions.

Form 41A750 is used by Business Development Corporations organized under the provisions of KRS 155.020.

Name of Corporation

Federal Identification Number

—

Street and Number

Date of Incorporation

State

ZIP Code

City

GROSS INCOME

1 Gross receipts/or sales $_________ Less: Returns and allowances $_________ ..

1

2 Less: Cost of goods sold and/or cost of operations (From Schedule A or

Schedule B) ...............................................................................................................

2

3 Gross profit (line 1 less line 2) .................................................................................

3

4 Dividends (From Schedule C) ..................................................................................

4

5 Interest on loans, notes, mortgages, bonds, bank deposits, etc. .........................

5

6 Interest on corporation bonds, etc. .........................................................................

6

7 Interest on governmental obligations subject to tax .............................................

7

8 Rents ..........................................................................................................................

8

9 Royalties ....................................................................................................................

9

10 Gains and losses (From Schedule D):

(a) Net short-term capital gain reduced by any net long-term capital loss ........ 10(a)

(b) Net long-term capital gain reduced by any net short-term capital loss ........ 10(b)

(c) Net gain (or loss) from sale or exchange of property other than capital assets . 10(c)

11 Other income (Attach schedule. Include Federal income tax refunds) ................

11

12 Total income on lines 3, and 4 through 11 ..................................................................................................................

12

DEDUCTIONS

13 Compensation of officers (From Schedule E) .........................................................

13

14 Salaries and wages (not deducted elsewhere) .......................................................

14

15 Rent ............................................................................................................................

15

16 Repairs (do not include cost of improvements or capital expenditures) .............

16

17 Bad debts (From Schedule F) ...................................................................................

17

18 Interest .......................................................................................................................

18

19 Taxes (From Schedule G) .........................................................................................

19

20 Contributions or gifts paid (From Schedule H) ......................................................

20

21 Losses by fire, storm, shipwreck, or other casualty, or theft (Submit schedule) ...

21

22 Depreciation and amortization (From Schedule I) .................................................

22

23 Depletion of mines, oil and gas wells, timber, etc. (Submit schedule) ................

23

24 Advertising ................................................................................................................

24

25 Amounts contributed under:

(a) A pension, annuity, stock bonus, or profit-sharing plan................................. 25(a)

(b) Other employee benefit plans ........................................................................... 25(b)

26 Other deductions authorized by law (From Schedule J) .......................................

26

27 Total deductions on lines 13 through 26 .....................................................................................................................

27

28 Net income (line 12 less line 27) ...................................................................................................................................

28

29 Federal income tax ........................................................................................................................................................

29

30 Taxable net income (line 28 less line 29) .....................................................................................................................

30

31 Tax Rate ..........................................................................................................................................................................

31

4.5%

32 TOTAL TAX (line 30 multiplied by line 31 or $10, whichever is greater) ..................................................................

32

Has the Internal Revenue Service made any changes in taxable income? Yes o No o. If “yes,” attach copy of changes to this return.

AFFIDAVIT

We, the undersigned, president (or vice president or secretary or treasurer or other principal officer) and chief accounting officer of the corporation

for which this return is made, being severally duly sworn, each for himself deposes and says that this return (including its accompanying schedules

and statements, if any) has been examined by him and is, to the best of his knowledge and belief, a true, correct and complete return, made

in good faith, for the taxable year stated. Pursuant to Chapter 155 of the Kentucky Revised Statutes, and any regulations issued thereunder.

Sworn to and subscribed before me this_______day of ________________, 20______

__________________________________________________________

(President or other principal officer)

(Title)

_______________________________________________________________

__________________________________________________________

(Signature of officer administering oath)

(Title)

(Chief Accounting Officer)

(Title)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4