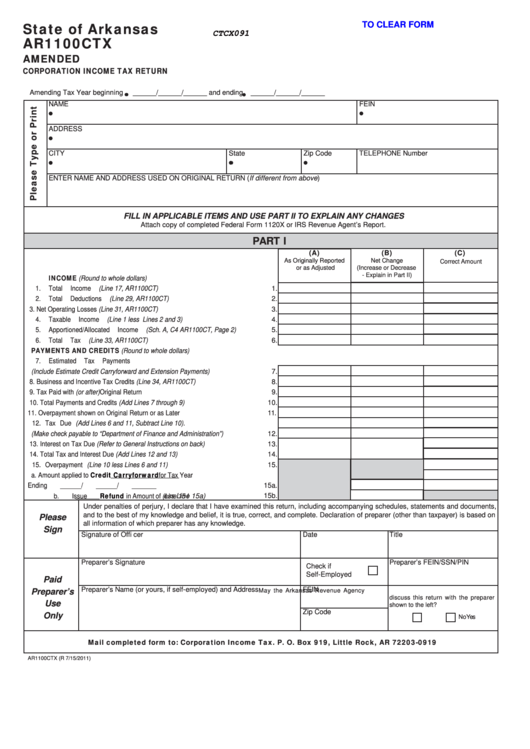

State of Arkansas

CLICK HERE TO CLEAR FORM

CTCX091

AR1100CTX

AMENDED

CORPORATION INCOME TAX RETURN

Amending Tax Year beginning

______/______/______ and ending

______/______/______

NAME

FEIN

ADDRESS

State

Zip Code

CITY

TELEPHONE Number

ENTER NAME AND ADDRESS USED ON ORIGINAL RETURN (If different from above)

FILL IN APPLICABLE ITEMS AND USE PART II TO EXPLAIN ANY CHANGES

Attach copy of completed Federal Form 1120X or IRS Revenue Agent’s Report.

PART I

(A)

(B)

(C)

As Originally Reported

Net Change

Correct Amount

or as Adjusted

(Increase or Decrease

INCOME (Round to whole dollars)

- Explain in Part II)

1.

Total Income (Line 17, AR1100CT)..........................................................................

1.

2.

Total Deductions (Line 29, AR1100CT) ...................................................................

2.

3.

Net Operating Losses (Line 31, AR1100CT) ...........................................................

3.

4.

Taxable Income (Line 1 less Lines 2 and 3) ...........................................................

4.

5.

Apportioned/Allocated Income (Sch. A, C4 AR1100CT, Page 2) .............................

5.

6.

Total Tax (Line 33, AR1100CT) ................................................................................

6.

PAYMENTS AND CREDITS (Round to whole dollars)

7.

Estimated Tax Payments

(Include Estimate Credit Carryforward and Extension Payments) ..........................

7.

8.

Business and Incentive Tax Credits (Line 34, AR1100CT) ......................................

8.

9.

9.

Tax Paid with (or after) Original Return ...................................................................

10.

Total Payments and Credits (Add Lines 7 through 9)............................................

10.

11.

Overpayment shown on Original Return or as Later Adjusted...............................

11.

12.

Tax Due (Add Lines 6 and 11, Subtract Line 10).

(Make check payable to “Department of Finance and Administration”).................

12.

13.

Interest on Tax Due (Refer to General Instructions on back).................................

13.

14.

Total Tax and Interest Due (Add Lines 12 and 13).................................................

14.

15.

Overpayment (Line 10 less Lines 6 and 11)..........................................................

15.

Credit Carryforward

a. Amount applied to

for Tax Year

Ending ______ / ______ / _______ ............................................................

15a.

Refund

b. Issue

in Amount of (Line 15 less Line 15a)...............................

15b.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, statements and documents,

and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on

Please

all information of which preparer has any knowledge.

Sign

Signature of Offi cer

Date

Title

Preparer’s Signature

Preparer’s FEIN/SSN/PIN

Check if

Self-Employed

Paid

Preparer’s Name (or yours, if self-employed) and Address

FEIN

Preparer’s

May the Arkansas Revenue Agency

discuss this return with the preparer

Use

shown to the left?

Zip Code

Only

Yes

No

Mail completed form to: Corporation Income Tax. P. O. Box 919, Little Rock, AR 72203-0919

AR1100CTX (R 7/15/2011)

1

1