Schedule Instructions

Complete a separate distribution schedule, Form MF-D, Motor vehicle Fuels Tax Schedule of Disbersments, for each product code and attach it to the appropriate tax return.

Complete a separate form for each schedule required. Prepare in duplicate and retain a copy for your file.

Schedule 5

Report taxable sales to licensed distributors only.

Schedule 6

Report nontaxable sales to licensed distributors.

Schedule 7

Report gallons exported to another state. You must complete a separate schedule for each state.

Schedule 8

Report nontaxable sales to U.S. government.

Schedule 9

Report nontaxable sales to the State of Connecticut and municipalities of this state. List each agency separately.

Schedule 10

Report nontaxable use, nontaxable sales to farmers, and other nontaxable distribution. Do not complete Form MF-D for sales of #2 heating oil for heating

purposes.

Schedule 13

Report credit card sales to governmental entities.

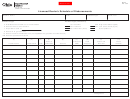

Column Instructions

Carrier - Enter the name and Federal Employer Identification Number (FEIN) of the company that transports the product.

Column (1) and (2)

Column (3)

Mode of Transportation - Enter the mode of transport. Use one of the following:

J = truck

R = rail

B = barge

PL = pipeline

S = ship (ocean marine vessel)

Column (4)

Point of Origin/Destination - Enter the location the product was transported from and to. When received into or from a terminal, use the Internal Revenue

Service (IRS) Terminal Control Number (TCN). These TCN’s are available at

Column (5)

Sold To - Enter the name of the company the product was sold to.

Column (6)

Purchaser FEIN - Enter the FEIN of the company the product was sold to.

Column (7)

Date Sold - Enter the date the product was sold. Rack sales may be consolidated by customer for the month.

Column (8)

Document Number - Rack sales, if not consolidated, must enter the identifying number from the document issued at the terminal. In case of pipeline or barge

movements, it is the pipeline or barge ticket number.

Column (9)

Billed Whole Gallons - Enter the number of gallons sold. Round off to the nearest whole gallon.

General Instructions

Diesel fuel, #2 oil, propane, natural gas, jet fuel, biodiesel, and kerosene are reported on Form OP-216, Special Fuel Tax Return. Gasoline, gasohol, and aviation gas are reported on

Form O-MF, Motor Vehicle Fuels Tax Return.

You must report monthly gallon subtotals by customer and product. All gallons must be rounded to the nearest whole gallon.

You must file a separate form for each product and include product code with schedule number.

Computer tab runs may be used as backup detail if preapproved by the Excise Taxes Unit. For further information on the motor vehicle fuels tax, call the Excise Taxes Unit at

860-541-3224, Monday through Friday, 8:30 a.m. to 4:30 p.m.

Form MF-D Back (Rev. 05/09)

1

1 2

2