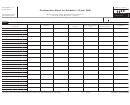

4

Schedule I (Form 990) (2012)

Page

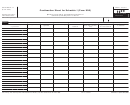

Line 2. Add the number of recipient

Enter the details of each type of assistance

securities exchange, measure market value by

organizations listed on Schedule I (Form 990),

to individuals on a separate line of Part III. If

the average of the highest and lowest quoted

Part II, line 1, that (a) have been recognized by

there are more types of assistance than space

selling prices or the average between the

the Internal Revenue Service as exempt from

available, report the types of assistance on

bona fide bid and asked prices, on the date

federal income tax as described in section

duplicate copies of Part III. Use as many

the property is distributed to the grantee.

501(c)(3), (b) are churches, including

duplicate copies as needed, and number each

When fair market value cannot be readily

synagogues, temples, and mosques, (c) are

page. Use Part IV if additional space is

determined, use an appraised or estimated

integrated auxiliaries of churches and

needed for descriptions of particular column

value.

conventions or association of churches, or (d)

entries.

Column (f). For noncash grants or assistance,

are governmental units or other government

Column (a). Specify type(s) of assistance

enter descriptions of property. List all that

entities in the United States. Enter the total.

provided, or describe the purpose or use of

apply. Examples of noncash assistance

Line 3. Add the number of recipient

grant funds. Do not use general terms such as

include medical supplies or equipment,

organizations listed on Schedule I (Form 990),

charitable, educational, religious, or scientific.

pharmaceuticals, blankets, and books or

Part II, line 1, that are not described on line 2.

Use more specific descriptions, such as

other educational supplies.

This number should include both

scholarships for students attending a

If the organization checks

organizations that are not tax-exempt and

particular school; provision of books or other

“Accrual” on Form 990, Part XII,

TIP

organizations that are tax-exempt under

educational supplies; food, clothing, and

line 1, follows SFAS 116 (ASC

section 501(c) but not section 501(c)(3).

shelter for indigents, or direct cash assistance

958) (see instructions for Form

to indigents; etc. In the case of specific

990, Part IX), and makes a grant during the

Part III. Grants and Other

disaster assistance, include a description of

tax year to be paid in future years to an

Assistance to Individuals in the

the type of assistance provided and identify

individual in the United States, it should report

United States

the disaster (for example, “Food, shelter, and

the grant's present value in Part III, column (c)

clothing for immediate relief for victims of

or (d), and report any accruals of present value

Complete Part III if the organization answered

Colorado wildfires”).

increments in future years.

“Yes” on Form 990, Part IV, line 22. A “Yes”

Column (b). Enter the number of recipients

response means that the organization

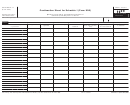

Part IV. Supplemental Information

for each type of assistance. If the organization

reported more than $5,000 on Form 990, Part

is unable to determine the actual number,

IX, line 2, column (A).

Use Part IV to provide narrative information

provide an estimate of the number. Explain in

required in Part I, line 2 regarding monitoring

Enter information for grants and other

Part IV how the organization arrived at the

of funds, and in Part III, column (b) regarding

assistance made to or for the benefit of

estimate.

how the organization estimated the number of

individual recipients. Do not complete Part III

Column (c). Enter the aggregate dollar

recipients for each type of grant or

for grants or assistance provided to

amount of cash grants for each type of grant

assistance. Also use Part IV to provide other

individuals through another organization or

or assistance. Cash grants include grants and

narrative explanations and descriptions, as

entity, unless the grant or assistance is

allocations paid by cash, check, money order,

needed. Identify the specific part and line(s)

earmarked by the filing organization for the

electronic fund or wire transfer, and other

that the response supports. Part IV can be

benefit of one or more specific individuals in

charges against funds on deposit at a

duplicated if more space is needed.

the United States. Instead, complete Part II,

financial institution.

earlier. For example, report a payment to a

hospital designated to cover the medical

Columns (d) and (e). Enter the fair market

expenses of particular U.S. individuals in Part

value of noncash property. Describe the

III and report a contribution to a hospital

method of valuation. Report property with a

designated to provide some service to the

readily determinable market value (for

general public or to unspecified U.S. charity

example, market quotations for securities) at

patients in Part II.

its fair market value. For marketable securities

registered and listed on a recognized

1

1 2

2 3

3 4

4