EXM (11-13)

Page 3

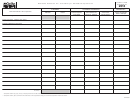

Schedule B - Summary of Taxes and Other Obligations

(1)

(2)

State of

State of

Incorporation Tax

New Jersey Tax

21 .

Total Life Tax Sch. A Col. 1, Line 10 -- Carry to Col. (1)

Total Life Tax Sch. A Col. 1, Line 20 -- Carry to Col. (2)

xxxxxxxxxxx

22 .

Total Annuity Tax Sch. A, Col. 2, Line 10 -- Carry to Col. (1)

23 .

Total Ind. A&H Tax Sch. A, Col. 3, Line 10 -- Carry to Col. (1)

Total Ind. A&H Tax Sch. A, Col. 3, Line 20 -- Carry to Col. (2)

24 .

Total Group A&H Tax Sch. A, Col. 4, Line 10 -- Carry to Col. (1)

Total Group A&H Tax Sch. A, Col. 4, Line 20 -- Carry to Col. (2)

xxxxxxxxxxx

Total Other Tax Sch. A Col. 5, Line 10 -- Carry to Col. (1)

25 .

26 .

Total Other Tax Sch. A Col. 6, Line 10 -- Carry to Col. (1)

Total Other Tax Sch. A Col. 6, Line 20 -- Carry to Col. (2)

27 .

Total Lines 21 to 26 Col. 1 and 2

(Should agree with Sch. A Col. 7 Line 10 and 20 respectively)

TAXABLE PREMIUMS AS DETERMINED WITH REFERENCE TO N.J.S.A. 54:18a-6

NOTE:

If Taxable Premiums are determined as provided in N.J.S.A. 54:18A-6 (12.5% Limitation), then

Schedule E -- Calculation of Taxable Premiums as Provided in N.J.S.A. 54:18A-6 -- must be

completed.

Sch. E. Sec. II Col. B

Foreign

New Jersey

Type

Tax

Tax

Total Premiums

Rate

Rate

2.1%

28 . Life

29 . Individual A & H

2.1%

1.05%

30 . Group A & H

xxxxx

31 . Total (Lines 28 thru 30)

XXXXXX

32 .

Total Tax (Lesser of Line 27 or 31, Sch.B Col. 1 and 2)

State of

State of

All other taxes, fees and obligations:

Incorporation Tax

New Jersey Tax

xxxxxxxxxxx

Company License

33 .

xxxxxxxxxxx

34 .

Filing fees

xxxxxxxxxxx

Income tax (Attach Schedule)

35 .

36 .

Agents and brokers license fees

As of 01/01/2011, no longer a part of the EXM return

Other * -- Attach Supporting Documentation

37 .

38 .

39 .

Total All Other -- (lines 33 thru 38, col. 1 & 2)

Total Tax -- (lines 32 plus 39, col. 1 & 2)

40 .

xxxxxxxxxxx

41 .

Retaliatory Tax -- (see instructions)

xxxxxxxxxxx

Total Tax due New Jersey -- (line 40 col. 2 plus line 41 col. 2)

42 .

CALCULATION OF TOTAL AMOUNT DUE

43 .

Other Credits * -- Attach Supporting Documentation

44 .

45 .

Guaranty Fund Assessment Credit (from Schedule D, Line 8 on Page 4)

46 .

Total Tax Credits (Total of Line 43 to line 45)

Balance of Tax Liability Due (Line 42 less line 46)

47 .

48 .

Credit for Prepayment of Premium Tax paid March 1 and June 1 of prior calendar year

Balance Due (Line 47 less line 48)

49 .

Prepayment of Tax liability due March 1st - (50% of line 32, column (2))

50 .

51 .

Total Amount Due State of New Jersey (Line 49 plus line 50)

If line 49 plus line 50 is less than zero enter the amount of the overpayment

52 .

53 .

Amount of line 52 to be applied to Prepayment of Tax liability due June 1st (see instructions)

The amount of line 52 to be refunded (If Line 52 plus Line 53 is less than zero)

54 .

PAYMENT OF THE AMOUNT INDICATED AT LINE 51 MUST BE SUBMITTED TO THE DIVISION OF TAXATION AT THE

ADDRESS INDICATED ON THE FIRST PAGE OF THIS RETURN.

NOTE: If the taxpayer is currently paying or has previously paid to the Department of Banking and Insurance, license and/or filing

fees attributable to the tax year covered by this return, such payments must be included at the appropriate Line(s) [Schedule B

Column 1 and/or 2 Lines 33 to 38}. The taxpayer should take credit for the amount of any of the above referenced license and/or

filing fees actually paid to the State of New Jersey. Such credits must be included at line 43 of Schedule B and a detailed schedule

must be attached to this return or the credit will be disallowed.

A copy of New Jersey State page, and, Schedule T as filed with the NAIC must be attached.

* Requires proof of payment

i.e. copies of cancelled checks

1

1 2

2 3

3 4

4 5

5 6

6