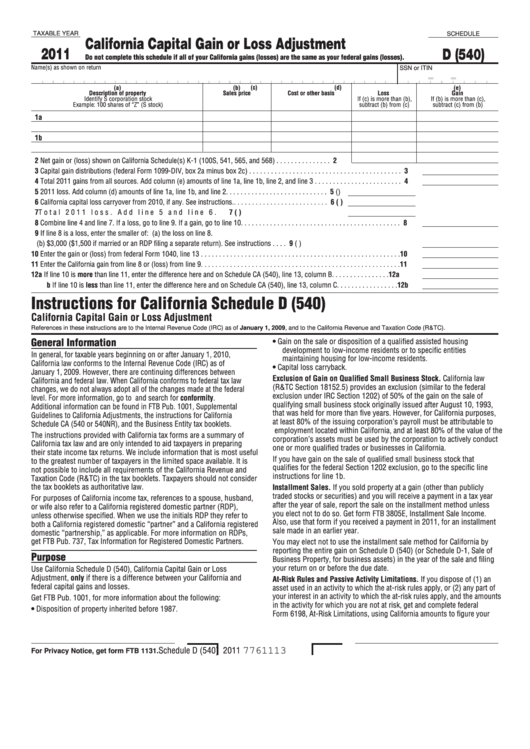

TAXABLE YEAR

SCHEDULE

California Capital Gain or Loss Adjustment

2011

D (540)

Do not complete this schedule if all of your California gains (losses) are the same as your federal gains (losses).

Name(s) as shown on return

SSN or ITIN

(a)

(b)

(c)

(d)

(e)

Description of property

Sales price

Cost or other basis

Loss

Gain

Identify S corporation stock

If (c) is more than (b),

If (b) is more than (c),

Example: 100 shares of “Z” (S stock)

subtract (b) from (c)

subtract (c) from (b)

1a

1b

2

Net gain or (loss) shown on California Schedule(s) K-1 (100S, 541, 565, and 568) . . . . . . . . . . . . . . . 2

3

Capital gain distributions (federal Form 1099-DIV, box 2a minus box 2c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Total 2011 gains from all sources. Add column (e) amounts of line 1a, line 1b, line 2, and line 3 . . . . . . . . . . . . . . . . . . . . . . . . 4

5

2011 loss. Add column (d) amounts of line 1a, line 1b, and line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 (

)

6

California capital loss carryover from 2010, if any. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . 6 (

)

7

Total 2011 loss. Add line 5 and line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 (

)

8

Combine line 4 and line 7. If a loss, go to line 9. If a gain, go to line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

If line 8 is a loss, enter the smaller of: (a) the loss on line 8.

(b) $3,000 ($1,500 if married or an RDP filing a separate return). See instructions . . . . 9 (

)

10

Enter the gain or (loss) from federal Form 1040, line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

11

Enter the California gain from line 8 or (loss) from line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11

12

a If line 10 is more than line 11, enter the difference here and on Schedule CA (540), line 13, column B. . . . . . . . . . . . . . . .12a

b If line 10 is less than line 11, enter the difference here and on Schedule CA (540), line 13, column C. . . . . . . . . . . . . . . . .12b

Instructions for California Schedule D (540)

California Capital Gain or Loss Adjustment

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

• Gain on the sale or disposition of a qualified assisted housing

development to low-income residents or to specific entities

In general, for taxable years beginning on or after January 1, 2010,

maintaining housing for low-income residents.

California law conforms to the Internal Revenue Code (IRC) as of

• Capital loss carryback.

January 1, 2009. However, there are continuing differences between

Exclusion of Gain on Qualified Small Business Stock. California law

California and federal law. When California conforms to federal tax law

(R&TC Section 18152.5) provides an exclusion (similar to the federal

changes, we do not always adopt all of the changes made at the federal

exclusion under IRC Section 1202) of 50% of the gain on the sale of

level. For more information, go to ftb.ca.gov and search for conformity.

qualifying small business stock originally issued after August 10, 1993,

Additional information can be found in FTB Pub. 1001, Supplemental

that was held for more than five years. However, for California purposes,

Guidelines to California Adjustments, the instructions for California

at least 80% of the issuing corporation’s payroll must be attributable to

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

employment located within California, and at least 80% of the value of the

The instructions provided with California tax forms are a summary of

corporation’s assets must be used by the corporation to actively conduct

California tax law and are only intended to aid taxpayers in preparing

one or more qualified trades or businesses in California.

their state income tax returns. We include information that is most useful

If you have gain on the sale of qualified small business stock that

to the greatest number of taxpayers in the limited space available. It is

qualifies for the federal Section 1202 exclusion, go to the specific line

not possible to include all requirements of the California Revenue and

instructions for line 1b.

Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider

the tax booklets as authoritative law.

Installment Sales. If you sold property at a gain (other than publicly

traded stocks or securities) and you will receive a payment in a tax year

For purposes of California income tax, references to a spouse, husband,

after the year of sale, report the sale on the installment method unless

or wife also refer to a California registered domestic partner (RDP),

you elect not to do so. Get form FTB 3805E, Installment Sale Income.

unless otherwise specified. When we use the initials RDP they refer to

Also, use that form if you received a payment in 2011, for an installment

both a California registered domestic “partner” and a California registered

sale made in an earlier year.

domestic “partnership,” as applicable. For more information on RDPs,

get FTB Pub. 737, Tax Information for Registered Domestic Partners.

You may elect not to use the installment sale method for California by

reporting the entire gain on Schedule D (540) (or Schedule D-1, Sale of

Purpose

Business Property, for business assets) in the year of the sale and filing

your return on or before the due date.

Use California Schedule D (540), California Capital Gain or Loss

Adjustment, only if there is a difference between your California and

At-Risk Rules and Passive Activity Limitations. If you dispose of (1) an

federal capital gains and losses.

asset used in an activity to which the at-risk rules apply, or (2) any part of

your interest in an activity to which the at-risk rules apply, and the amounts

Get FTB Pub. 1001, for more information about the following:

in the activity for which you are not at risk, get and complete federal

• Disposition of property inherited before 1987.

Form 6198, At-Risk Limitations, using California amounts to figure your

Schedule D (540) 2011

7761113

For Privacy Notice, get form FTB 1131.

1

1 2

2