Form Wec - Withholding Exemption Certificate - 2002

ADVERTISEMENT

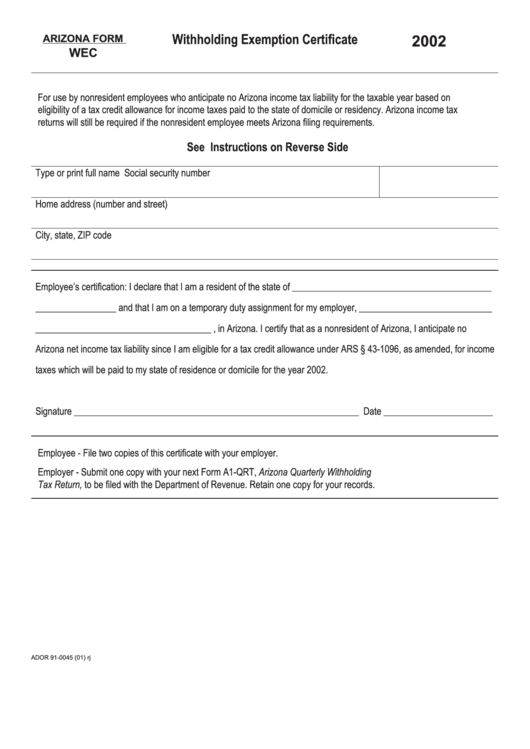

Withholding Exemption Certicate

2002

ARIZONA FORM

WEC

For use by nonresident employees who anticipate no Arizona income tax liability for the taxable year based on

eligibility of a tax credit allowance for income taxes paid to the state of domicile or residency. Arizona income tax

returns will still be required if the nonresident employee meets Arizona ling requirements.

See Instructions on Reverse Side

Type or print full name

Social security number

Home address (number and street)

City, state, ZIP code

Employee’s certication: I declare that I am a resident of the state of __________________________________________

_________________ and that I am on a temporary duty assignment for my employer, ____________________________

_____________________________________ , in Arizona. I certify that as a nonresident of Arizona, I anticipate no

Arizona net income tax liability since I am eligible for a tax credit allowance under ARS § 43-1096, as amended, for income

taxes which will be paid to my state of residence or domicile for the year 2002.

Signature ____________________________________________________________ Date _______________________

Employee - File two copies of this certicate with your employer.

Employer - Submit one copy with your next Form A1-QRT, Arizona Quarterly Withholding

Tax Return, to be led with the Department of Revenue. Retain one copy for your records.

ADOR 91-0045 (01) rj

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1