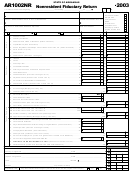

Form Ar1002nr - Nonresident Fiduciary Return - 2013 Page 2

ADVERTISEMENT

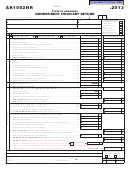

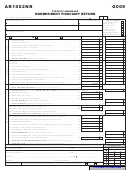

Schedule A: Capital Gains Worksheet (Attach Federal Schedule D)

In Arkansas only 70% of net long term capital gain is taxed. 100% of short term capital gains is taxed.

Complete this worksheet if you have a NET CAPITAL GAIN OR LOSS reported on federal Schedule D, federal Form 1041. The amount of

capital loss that may be deducted after offsetting capital gains is limited to $3,000.

Adjust your gains and losses for any depreciation differences, if any, in the federal and Arkansas amounts using Lines 2, 5 and 10. *

*(Arkansas did not adopt the federal “bonus depreciation” provision from previous years. Therefore, there may be a

difference in federal and Arkansas amounts of depreciation allowed.)

Per Sch D, Form 1041

Arkansas

1.

Enter federal long-term capital gain or loss reported on Line 12,

00

00

Schedule D, Form 1041 ............................................................................................................ 1

Enter adjustment, if any, for depreciation differences in federal and state

2.

00

amounts ...............................................................................................................................................................................2

00

3.

Arkansas long-term capital gain or loss, add (or subtract) Line 1 and Line 2 ...................................................................... 3

Enter federal net short-term capital loss, if any, reported

4.

00

00

on Line 5, Schedule D, Form 1041 ........................................................................................... 4

Enter adjustment, if any, for depreciation differences in federal and state

5.

00

amounts ...............................................................................................................................................................................5

00

6.

Arkansas net short-term capital loss, add (or subtract) Line 4 and Line 5........................................................................... 6

00

7.

Arkansas net capital gain or loss (If gain, subtract Line 6 from 3. If loss add Lines 6 and 3) .............................................. 7

00

Arkansas taxable amount. If a gain, multiply Line 7 by 70 percent (.70), otherwise enter loss ..................................... 8

8.

Enter federal short-term capital gain, if any, reported on

9.

00

00

Line 5, Schedule D, Form 1041 ................................................................................................ 9

Enter adjustment, if any, for depreciation differences in federal and state

10.

00

amounts .............................................................................................................................................................................10

00

11.

Arkansas short-term capital gain, add (or subtract) Line 9 and Line 10 ............................................................................ 11

Total taxable Arkansas capital gain or loss, add Lines 8 and 11, (loss limited to $3,000),

12.

00

enter here and on Line 4, Form AR1002F/AR1002NR ...................................................................................................... 12

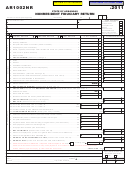

Schedule B: Income Distribution (Attach Federal K-1s)

Beneficiaries’ share of income: ___________________________

Number of beneficiaries who received distributions: ___________

FIRST NAME

MI

LAST NAME

SSN

ADDRESS

ST

ZIP

AMOUNT

00

00

00

00

00

00

00

00

00

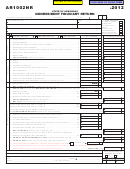

Mail TAX DUE to: State Income Tax, P. O. Box 2144, Little Rock, AR 72203-2144

Mail AMENDED to:

State Income Tax, P. O. Box 3628, Little Rock, AR 72203-3628

Mail REFUND to: State Income Tax, P. O. Box 1000, Little Rock, AR 72203-1000

Mail NO TAX DUE to: State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026

AR1002 (R 10/6/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2