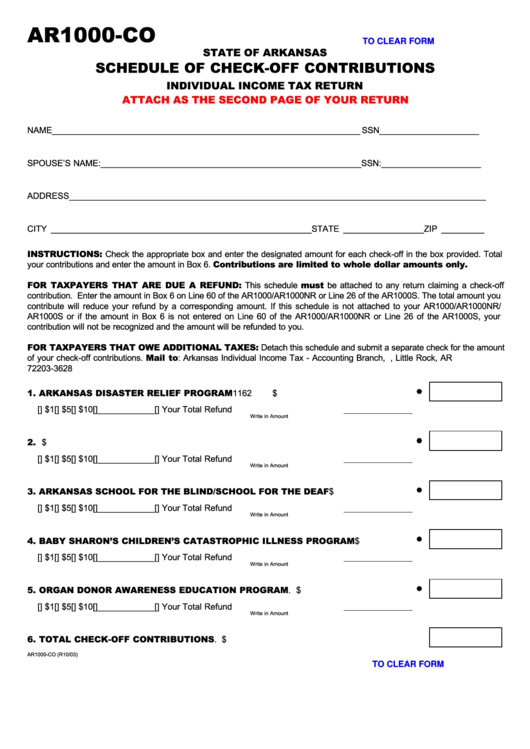

AR1000-CO

CLICK HERE TO CLEAR FORM

STATE OF ARKANSAS

SCHEDULE OF CHECK-OFF CONTRIBUTIONS

INDIVIDUAL INCOME TAX RETURN

ATTACH AS THE SECOND PAGE OF YOUR RETURN

NAME _________________________________________________________________ SSN _____________________

SPOUSE’S NAME: _______________________________________________________ SSN: _____________________

ADDRESS ________________________________________________________________________________________

CITY _______________________________________________________ STATE _________________ ZIP _________

INSTRUCTIONS: Check the appropriate box and enter the designated amount for each check-off in the box provided. Total

your contributions and enter the amount in Box 6. Contributions are limited to whole dollar amounts only.

FOR TAXPAYERS THAT ARE DUE A REFUND: This schedule must be attached to any return claiming a check-off

contribution. Enter the amount in Box 6 on Line 60 of the AR1000/AR1000NR or Line 26 of the AR1000S. The total amount you

contribute will reduce your refund by a corresponding amount. If this schedule is not attached to your AR1000/AR1000NR/

AR1000S or if the amount in Box 6 is not entered on Line 60 of the AR1000/AR1000NR or Line 26 of the AR1000S, your

contribution will not be recognized and the amount will be refunded to you.

FOR TAXPAYERS THAT OWE ADDITIONAL TAXES: Detach this schedule and submit a separate check for the amount

of your check-off contributions. Mail to: Arkansas Individual Income Tax - Accounting Branch, P.O. Box 3628, Little Rock, AR

72203-3628

1. ARKANSAS DISASTER RELIEF PROGRAM. ....................................................... CLS 1162

$

[

] $1

[

] $5

[

] $10

[

] ____________

[

] Your Total Refund

Write in Amount

2. U.S. OLYMPIC COMMITTEE PROGRAM. ............................................................ CLS 1145

$

[

] $1

[

] $5

[

] $10

[

] ____________

[

] Your Total Refund

Write in Amount

3. ARKANSAS SCHOOL FOR THE BLIND/SCHOOL FOR THE DEAF. ............... CLS 1164

$

[

] $1

[

] $5

[

] $10

[

] ____________

[

] Your Total Refund

Write in Amount

4. BABY SHARON’S CHILDREN’S CATASTROPHIC ILLNESS PROGRAM. ..... CLS 1144

$

[

] $1

[

] $5

[

] $10

[

] ____________

[

] Your Total Refund

Write in Amount

5. ORGAN DONOR AWARENESS EDUCATION PROGRAM. ................................ CLS 1146

$

[

] $1

[

] $5

[

] $10

[

] ____________

[

] Your Total Refund

Write in Amount

6. TOTAL CHECK-OFF CONTRIBUTIONS. ...................................................................................

$

AR1000-CO (R10/03)

CLICK HERE TO CLEAR FORM

1

1