Warren County Schools Quarterly Occupational Tax Return Form

ADVERTISEMENT

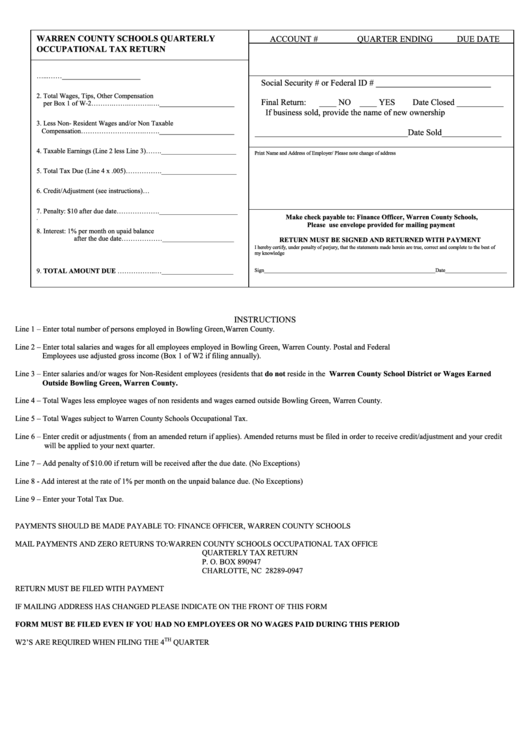

WARREN COUNTY SCHOOLS QUARTERLY

ACCOUNT #

QUARTER ENDING

DUE DATE

OCCUPATIONAL TAX RETURN

1.Total Number of Paid Employees…...……_______________________

Social Security # or Federal ID # ___________________________

2. Total Wages, Tips, Other Compensation

Final Return:

____ NO ____ YES

Date Closed ___________

per Box 1 of W-2……….…….……….….______________________

If business sold, provide the name of new ownership

3. Less Non- Resident Wages and/or Non Taxable

Compensation……………………….…….______________________

____________________________________Date Sold______________

4. Taxable Earnings (Line 2 less Line 3)…….______________________

Print Name and Address of Employer/ Please note change of address

5. Total Tax Due (Line 4 x .005)…………….______________________

6. Credit/Adjustment (see instructions)…......______________________

7. Penalty: $10 after due date………………._______________________

Make check payable to: Finance Officer, Warren County Schools,

.

Please use envelope provided for mailing payment

8. Interest: 1% per month on upaid balance

after the due date………………_____________________

RETURN MUST BE SIGNED AND RETURNED WITH PAYMENT

I hereby certify, under penalty of perjury, that the statements made herein are true, correct and complete to the best of

my knowledge

9. TOTAL AMOUNT DUE ……………..…_____________________

Sign________________________________________________________________Date_________________________

INSTRUCTIONS

Line 1 – Enter total number of persons employed in Bowling Green,Warren County.

Line 2 – Enter total salaries and wages for all employees employed in Bowling Green, Warren County. Postal and Federal

Employees use adjusted gross income (Box 1 of W2 if filing annually).

Line 3 – Enter salaries and/or wages for Non-Resident employees (residents that do not reside in the Warren County School District or Wages Earned

Outside Bowling Green, Warren County.

Line 4 – Total Wages less employee wages of non residents and wages earned outside Bowling Green, Warren County.

Line 5 – Total Wages subject to Warren County Schools Occupational Tax.

Line 6 – Enter credit or adjustments ( from an amended return if applies). Amended returns must be filed in order to receive credit/adjustment and your credit

will be applied to your next quarter.

Line 7 – Add penalty of $10.00 if return will be received after the due date. (No Exceptions)

Line 8 - Add interest at the rate of 1% per month on the unpaid balance due. (No Exceptions)

Line 9 – Enter your Total Tax Due.

PAYMENTS SHOULD BE MADE PAYABLE TO:

FINANCE OFFICER, WARREN COUNTY SCHOOLS

MAIL PAYMENTS AND ZERO RETURNS TO:

WARREN COUNTY SCHOOLS OCCUPATIONAL TAX OFFICE

QUARTERLY TAX RETURN

P. O. BOX 890947

CHARLOTTE, NC 28289-0947

RETURN MUST BE FILED WITH PAYMENT

IF MAILING ADDRESS HAS CHANGED PLEASE INDICATE ON THE FRONT OF THIS FORM

FORM MUST BE FILED EVEN IF YOU HAD NO EMPLOYEES OR NO WAGES PAID DURING THIS PERIOD

TH

W2’S ARE REQUIRED WHEN FILING THE 4

QUARTER

THE WARREN COUNTY SCHOOLS OCCUPATIONAL TAX SHOULD BE FILED SEPARATELY FROM THE CITY OF BOWLING GREEN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1