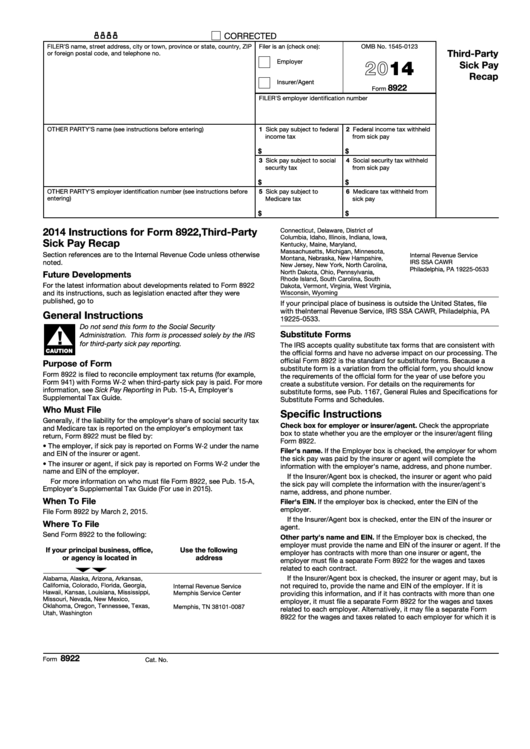

CORRECTED

8888

FILER'S name, street address, city or town, province or state, country, ZIP

Filer is an (check one):

OMB No. 1545-0123

Third-Party

or foreign postal code, and telephone no.

2014

Employer

Sick Pay

Recap

Insurer/Agent

8922

Form

FILER'S employer identification number

1 Sick pay subject to federal

2 Federal income tax withheld

OTHER PARTY'S name (see instructions before entering)

income tax

from sick pay

$

$

3 Sick pay subject to social

4 Social security tax withheld

security tax

from sick pay

$

$

OTHER PARTY'S employer identification number (see instructions before

5 Sick pay subject to

6 Medicare tax withheld from

entering)

Medicare tax

sick pay

$

$

2014 Instructions for Form 8922,Third-Party

Connecticut, Delaware, District of

Columbia, Idaho, Illinois, Indiana, Iowa,

Sick Pay Recap

Kentucky, Maine, Maryland,

Massachusetts, Michigan, Minnesota,

Section references are to the Internal Revenue Code unless otherwise

Internal Revenue Service

Montana, Nebraska, New Hampshire,

noted.

IRS SSA CAWR

New Jersey, New York, North Carolina,

Philadelphia, PA 19225-0533

North Dakota, Ohio, Pennsylvania,

Future Developments

Rhode Island, South Carolina, South

For the latest information about developments related to Form 8922

Dakota, Vermont, Virginia, West Virginia,

and its instructions, such as legislation enacted after they were

Wisconsin, Wyoming

published, go to

If your principal place of business is outside the United States, file

with the Internal Revenue Service, IRS SSA CAWR, Philadelphia, PA

General Instructions

19225-0533.

Do not send this form to the Social Security

▲

!

Substitute Forms

Administration. This form is processed solely by the IRS

for third-party sick pay reporting.

The IRS accepts quality substitute tax forms that are consistent with

CAUTION

the official forms and have no adverse impact on our processing. The

official Form 8922 is the standard for substitute forms. Because a

Purpose of Form

substitute form is a variation from the official form, you should know

Form 8922 is filed to reconcile employment tax returns (for example,

the requirements of the official form for the year of use before you

Form 941) with Forms W-2 when third-party sick pay is paid. For more

create a substitute version. For details on the requirements for

information, see Sick Pay Reporting in Pub. 15-A, Employer's

substitute forms, see Pub. 1167, General Rules and Specifications for

Supplemental Tax Guide.

Substitute Forms and Schedules.

Who Must File

Specific Instructions

Generally, if the liability for the employer’s share of social security tax

Check box for employer or insurer/agent. Check the appropriate

and Medicare tax is reported on the employer’s employment tax

box to state whether you are the employer or the insurer/agent filing

return, Form 8922 must be filed by:

Form 8922.

• The employer, if sick pay is reported on Forms W‐2 under the name

Filer's name. If the Employer box is checked, the employer for whom

and EIN of the insurer or agent.

the sick pay was paid by the insurer or agent will complete the

• The insurer or agent, if sick pay is reported on Forms W‐2 under the

information with the employer's name, address, and phone number.

name and EIN of the employer.

If the Insurer/Agent box is checked, the insurer or agent who paid

For more information on who must file Form 8922, see Pub. 15‐A,

the sick pay will complete the information with the insurer/agent's

Employer’s Supplemental Tax Guide (For use in 2015).

name, address, and phone number.

When To File

Filer's EIN. If the employer box is checked, enter the EIN of the

employer.

File Form 8922 by March 2, 2015.

If the Insurer/Agent box is checked, enter the EIN of the insurer or

Where To File

agent.

Send Form 8922 to the following:

Other party's name and EIN. If the Employer box is checked, the

employer must provide the name and EIN of the insurer or agent. If the

If your principal business, office,

Use the following

employer has contracts with more than one insurer or agent, the

or agency is located in

address

employer must file a separate Form 8922 for the wages and taxes

related to each contract.

If the Insurer/Agent box is checked, the insurer or agent may, but is

Alabama, Alaska, Arizona, Arkansas,

California, Colorado, Florida, Georgia,

not required to, provide the name and EIN of the employer. If it is

Internal Revenue Service

Hawaii, Kansas, Louisiana, Mississippi,

Memphis Service Center

providing this information, and if it has contracts with more than one

Missouri, Nevada, New Mexico,

P.O. Box 87 Mail Stop 814D6

employer, it must file a separate Form 8922 for the wages and taxes

Oklahoma, Oregon, Tennessee, Texas,

Memphis, TN 38101-0087

related to each employer. Alternatively, it may file a separate Form

Utah, Washington

8922 for the wages and taxes related to each employer for which it is

8922

Form

Cat. No. 37734T

IRS.gov/form8922

Department of the Treasury - Internal Revenue Service

1

1 2

2