2

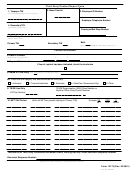

Form 8922 (2014)

Page

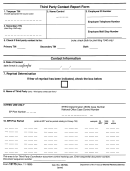

supplying the name and EIN, and then file one Form 8922 for the

Generally, tax returns and return information are confidential, as

wages and taxes related to the employers for which it is not supplying

required by section 6103. However, section 6103 allows or requires

the name and EIN.

the Internal Revenue Service to disclose or give the information shown

on your return to others as described in the Code. For example, we

Box 1. Enter the total amount of sick pay subject to federal income

may disclose your tax information to the Department of Justice for

tax.

civil and/or criminal litigation, and to cities, states, the District of

Box 2. Enter the total amount of federal income tax withheld from the

Columbia, and U.S. commonwealths and possessions for use in

sick pay.

administering their tax laws. We may also disclose this information to

Box 3. Enter the total amount of sick pay subject to social security

other countries under a tax treaty, to federal and state agencies to

tax.

enforce federal nontax criminal laws, or to federal law enforcement

Box 4. Enter the total amount of social security tax withheld from the

and intelligence agencies to combat terrorism.

sick pay.

You are not required to provide the information requested on a form

Box 5. Enter the total amount of sick pay subject to Medicare tax.

that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

Box 6. Enter the total amount of the Medicare tax (including Additional

form or its instructions must be retained as long as their contents may

Medicare Tax) withheld from the sick pay.

become material in the administration of any Internal Revenue law.

Corrected Form 8922. If you filed Form 8922 with the IRS and later

The time needed to complete and file this form will vary depending

discover that you made an error on it, you must correct it as soon as

on individual circumstances. The estimated burden for business

possible. Complete all entries on Form 8922 when making a

taxpayers filing this form is approved under OMB control number

correction. Enter an “X” in the “CORRECTED” checkbox only when

1545-0123 and is included in the estimates shown in the instructions

correcting a Form 8922 previously filed with the IRS.

for their business income tax return.

Recordkeeping. Keep all records of employment taxes for at least 4

If you have comments concerning the accuracy of these time

years. These should be available for IRS review.

estimates or suggestions for making Form 8922 simpler, we would be

Privacy Act and Paperwork Reduction Act Notice. We ask for the

happy to hear from you. You can send us comments from

information on this form to carry out the Internal Revenue laws of the

gov/formspubs. Click on More Information and then click on Give us

United States. We need it to figure and collect the right amount of tax.

feedback. Or you can send your comments to Internal Revenue

Section 6051 and its regulations require you to furnish wage and tax

Service, Tax Forms and Publications Division, 1111 Constitution

statements to employees, the Social Security Administration, and the

Avenue, NW, IR-6526, Washington, DC 20224. Do not send Form

Internal Revenue Service. Section 6109 requires you to provide your

8922 to this address. Instead, see Where To File, earlier.

identification number. Failure to provide this information in a timely

manner or providing false or fraudulent information may subject you to

penalties.

1

1 2

2