RESIDENT/NON-RESIDENT DEALER’S

FORM

323

MONTHLY REPORT OF BEER DELIVERIES

INTO MARYLAND INSTRUCTIONS

This report, together with Form COM/RAD 324, shall be filed and physically received

Contact information:

by the Revenue Administration Division no later than the 15th day of the month,

COMPTROLLER OF MARyLAND

following the month which it covers.

REvENUE ADMINISTRATION DIvISION

Insert in the spaces provided, the Non-Resident Brewery, Non-Resident or

ALCOHOL TAx

Resident Dealer name and Non-Resident Brewery, Non-Resident or Resident Dealer

PO BOx 2999

permit number.

ANNAPOLIS MD 21404-2999

410-260-7127

In the space provided, indicate the report month and year.

FAx: 410-260-7924

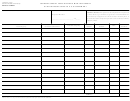

Column

Line

Allotting one COM/RAD 323 for each consignee, insert

the name of the receiving entity within the State of Maryland

Tax/Filing_Information/

(Maryland Wholesaler).

1

1-23

Insert the date the shipment was made.

2

1-23

Insert the invoice number for each shipment.

3

1-23

If you are a supplier of foreign brewed beer and you have

elected to pay the Maryland beer tax covering each individual

order prior to delivery within Maryland, the applicable foreign

beer release certificate number should be recorded in column 3

beside its corresponding invoice number.

4-15

1-23

Insert the number of cases or kegs of each size shipped. Use

additional sheets if necessary. List returns in the same manner

as deliveries, but as deductions minus quantities).

4-15

24

Insert the total number of cases or kegs shipped to this

consignee total lines 1-27.

4-15

25

This line is to be used for the appropriate container-to-gallons

conversion factor for each container size.

4-15

26

Insert the total number of gallons for each container size.

16

26

Insert the grand total in gallons of beer shipped to this

consignee. Complete only one line 26 for each consignee even

if multiple sheets are used.

Note:

Beer may not be sold for consumption within this state or sold

or delivered to the holder of a wholesale or retail license in

container sizes of less than 6.33 ounces.

COM/RAD 323

08/13

1

1 2

2