CLICK HERE TO CLEAR FORM

Click Here to Print Document

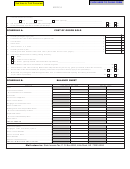

PTPT131

A. Check method of accounting

Cash

Accrual

Other: (Specify) _____________________________________

B. Are any partners in this partnership also partnerships? ........................................................................................................

Yes

No

C. Is this partnership a partner in another partnership? .............................................................................................................

Yes

No

SCHEDULE A:

COST OF GOODS SOLD

00

1.

Inventory at beginning of year: .............................................................................................................................................. 1

00

2.

Purchases less cost of items withdrawn for personal use: .................................................................................................... 2

00

3.

Cost of labor: ......................................................................................................................................................................... 3

00

4.

Other costs: ........................................................................................................................................................................... 4

00

5.

Total of Lines 1, 2, 3, and 4:................................................................................................................................................... 5

00

6.

Inventory at end of year: ........................................................................................................................................................ 6

00

7.

Cost of goods sold. Subtract Line 6 from Line 5. (Enter here and on Line 2, page 1): .......................................................... 7

8a. Check all methods used for valuing closing inventory:

(i)

Cost

(ii) Lower of cost or market

(iii) Other: (Specify method used and attach explanation) ____________________________

b. Check this box if there was a writedown of “subnormal” goods. ..............................................................................................................8b

c. Check this box if the LIFO Inventory Method was adopted this tax year for any goods (If checked, attach IRS Form 970) .................... 8c

d. Do the rules of IRC Section 263A (for property produced or acquired for resale) apply to the partnership? ...........................8d

Yes

No

e. Were there any changes in determining quantities, cost, or valuations between opening and closing inventories?

(If yes, attach explanation) .......................................................................................................................................................8e

Yes

No

SCHEDULE B:

BALANCE SHEET

ASSETS

BEGINNING OF YEAR

END OF YEAR

Cash

Accounts Receivable .........................................................

Minus allowance for bad debts........................................

Inventories .........................................................................

Government obligations .....................................................

Other current assets ..........................................................

Mortgage and real estate loans .........................................

Other investments ..............................................................

Buildings and other depreciable assets .............................

Minus accumulated depreciation.....................................

Depletable assets ..............................................................

Minus accumulated depletion..........................................

Other assets ......................................................................

TOTAL ASSETS .............................................................

LIABILITIES AND CAPITAL

BEGINNING OF YEAR

END OF YEAR

Accounts Payable ..............................................................

Mortgages, notes, and bonds payable ...............................

Other current liabilities .......................................................

All non recourse loans .......................................................

Other liabilities ...................................................................

Partners’ capital accounts ..................................................

TOTAL LIABILITIES AND CAPITAL .........................

Mail return to: State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026

AR1050 Back (R 7/13/2011)

1

1 2

2