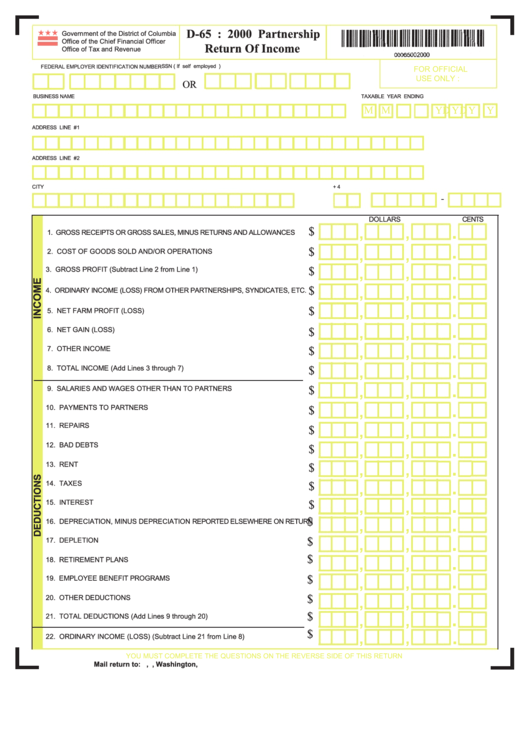

Form D-65 - Partnership Return Of Income - 2000

ADVERTISEMENT

D-65 : 2000 Partnership

Government of the District of Columbia

Office of the Chief Financial Officer

Return Of Income

Office of Tax and Revenue

SSN ( If self employed )

FEDERAL EMPLOYER IDENTIFICATION NUMBER

FOR OFFICIAL

USE ONLY :

OR

BUSINESS NAME

TAXABLE YEAR ENDING

M M

D D

Y

Y

Y

Y

ADDRESS LINE #1

ADDRESS LINE #2

CITY

ST.

ZIP + 4

-

DOLLARS

CENTS

.

$

,

,

1. GROSS RECEIPTS OR GROSS SALES, MINUS RETURNS AND ALLOWANCES

.

$

2. COST OF GOODS SOLD AND/OR OPERATIONS .....................................................

,

,

.

3. GROSS PROFIT (Subtract Line 2 from Line 1) ......................................................

$

,

,

.

$

,

,

4. ORDINARY INCOME (LOSS) FROM OTHER PARTNERSHIPS, SYNDICATES, ETC.

.

$

,

,

5. NET FARM PROFIT (LOSS) ...................................................................................

.

6. NET GAIN (LOSS) .................................................................................................

,

$

,

.

7. OTHER INCOME .....................................................................................................

$

,

,

.

8. TOTAL INCOME (Add Lines 3 through 7) .............................................................

$

,

,

.

$

9. SALARIES AND WAGES OTHER THAN TO PARTNERS .......................................

,

,

.

10. PAYMENTS TO PARTNERS ...................................................................................

$

,

,

.

11. REPAIRS ..............................................................................................................

$

,

,

.

12. BAD DEBTS ........................................................................................................

$

,

,

.

13. RENT ...................................................................................................................

$

,

,

.

14. TAXES .................................................................................................................

$

,

,

.

15. INTEREST ............................................................................................................

$

,

,

.

$

16. DEPRECIATION, MINUS DEPRECIATION REPORTED ELSEWHERE ON RETURN

,

,

.

$

17. DEPLETION ..........................................................................................................

,

,

.

$

18. RETIREMENT PLANS ...........................................................................................

,

,

.

$

19. EMPLOYEE BENEFIT PROGRAMS .......................................................................

,

,

.

20. OTHER DEDUCTIONS ..........................................................................................

$

,

,

.

$

21. TOTAL DEDUCTIONS (Add Lines 9 through 20) .................................................

,

,

.

$

,

,

22. ORDINARY INCOME (LOSS) (Subtract Line 21 from Line 8) ..............................

YOU MUST COMPLETE THE QUESTIONS ON THE REVERSE SIDE OF THIS RETURN

Mail return to: D.C. Government Office of Tax and Revenue, P.O. Box 447, Washington, D.C. 20044-0447

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2