Irrevocable Unconditional Letter Of Credit

ADVERTISEMENT

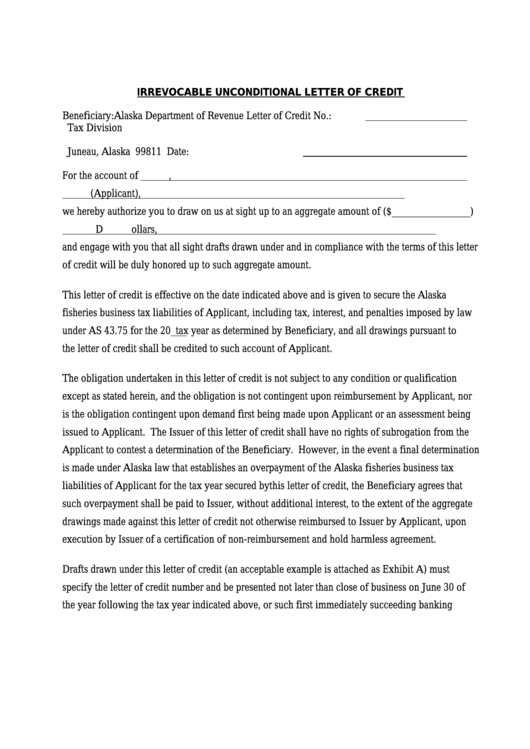

IRREVOCABLE UNCONDITIONAL LETTER OF CREDIT

Beneficiary:

Alaska Department of Revenue

Letter of Credit No.:

Tax Division

P.O. Box 110420

Juneau, Alaska 99811

Date:

For the account of

,

(Applicant),

we hereby authorize you to draw on us at sight up to an aggregate amount of ($_______________)

Dollars,

and engage with you that all sight drafts drawn under and in compliance with the terms of this letter

of credit will be duly honored up to such aggregate amount.

This letter of credit is effective on the date indicated above and is given to secure the Alaska

fisheries business tax liabilities of Applicant, including tax, interest, and penalties imposed by law

under AS 43.75 for the 20

tax year as determined by Beneficiary, and all drawings pursuant to

the letter of credit shall be credited to such account of Applicant.

The obligation undertaken in this letter of credit is not subject to any condition or qualification

except as stated herein, and the obligation is not contingent upon reimbursement by Applicant, nor

is the obligation contingent upon demand first being made upon Applicant or an assessment being

issued to Applicant. The Issuer of this letter of credit shall have no rights of subrogation from the

Applicant to contest a determination of the Beneficiary. However, in the event a final determination

is made under Alaska law that establishes an overpayment of the Alaska fisheries business tax

liabilities of Applicant for the tax year secured by this letter of credit, the Beneficiary agrees that

such overpayment shall be paid to Issuer, without additional interest, to the extent of the aggregate

drawings made against this letter of credit not otherwise reimbursed to Issuer by Applicant, upon

execution by Issuer of a certification of non-reimbursement and hold harmless agreement.

Drafts drawn under this letter of credit (an acceptable example is attached as Exhibit A) must

specify the letter of credit number and be presented not later than close of business on June 30 of

the year following the tax year indicated above, or such first immediately succeeding banking

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5