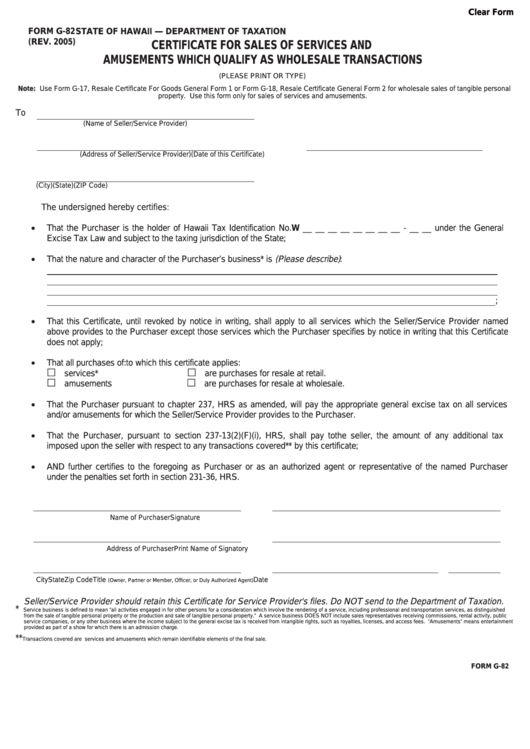

Clear Form

FORM G-82

STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2005)

CERTIFICATE FOR SALES OF SERVICES AND

AMUSEMENTS WHICH QUALIFY AS WHOLESALE TRANSACTIONS

(PLEASE PRINT OR TYPE)

Note: Use Form G-17, Resale Certificate For Goods General Form 1 or Form G-18, Resale Certificate General Form 2 for wholesale sales of tangible personal

property. Use this form only for sales of services and amusements.

To

(Name of Seller/Service Provider)

(Address of Seller/Service Provider)

(Date of this Certificate)

(City)

(State)

(ZIP Code)

The undersigned hereby certifies:

•

That the Purchaser is the holder of Hawaii Tax Identification No. W __ __ __ __ __ __ __ __ - __ __ under the General

Excise Tax Law and subject to the taxing jurisdiction of the State;

•

That the nature and character of the Purchaser’s business* is (Please describe) :

;

•

That this Certificate, until revoked by notice in writing, shall apply to all services which the Seller/Service Provider named

above provides to the Purchaser except those services which the Purchaser specifies by notice in writing that this Certificate

does not apply;

•

That all purchases of:

to which this certificate applies:

£

£

services*

are purchases for resale at retail.

£

£

amusements

are purchases for resale at wholesale.

•

That the Purchaser pursuant to chapter 237, HRS as amended, will pay the appropriate general excise tax on all services

and/or amusements for which the Seller/Service Provider provides to the Purchaser.

•

That the Purchaser, pursuant to section 237-13(2)(F)(i), HRS, shall pay to the seller, the amount of any additional tax

imposed upon the seller with respect to any transactions covered** by this certificate;

•

AND further certifies to the foregoing as Purchaser or as an authorized agent or representative of the named Purchaser

under the penalties set forth in section 231-36, HRS.

Name of Purchaser

Signature

Address of Purchaser

Print Name of Signatory

City

State

Zip Code

Title

Date

(Owner, Partner or Member, Officer, or Duly Authorized Agent)

Seller/Service Provider should retain this Certificate for Service Provider's files. Do NOT send to the Department of Taxation.

*

Service business is defined to mean “all activities engaged in for other persons for a consideration which involve the rendering of a service, including professional and transportation services, as distinguished

from the sale of tangible personal property or the production and sale of tangible personal property.” A service business DOES NOT include sales representatives receiving commissions, rental activity, public

service companies, or any other business where the income subject to the general excise tax is received from intangible rights, such as royalties, licenses, and access fees. “Amusements” means entertainment

provided as part of a show for which there is an admission charge.

**

Transactions covered are services and amusements which remain identifiable elements of the final sale.

FORM G-82

1

1