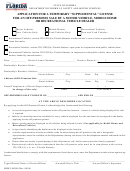

Form Mt-202 - Application For A License As A Wholesale Dealer Of Tobacco Products Or An Appointment As A Distributor Of Tobacco Products Page 2

ADVERTISEMENT

Page 2 of 4 MT-202 (6/08)

11 Enter the names and addresses of your tobacco product suppliers

(see instructions; attach additional sheets if necessary).

Name

Address

12 Is your business currently registered or do you have tax accounts with New York State for the following taxes?

a. Cigarette tax (Article 20)

Yes

No

b. Corporation tax

Yes

No

If Yes, enter identification number(s):

c. Withholding tax

Yes

No

Registered chain store

d. Sales tax

Yes

No

Agent

e. Highway use tax

Yes

No

Wholesale dealer

f. Other taxes

Yes

No

CMSA licensed wholesale dealer

Specify type of taxes

13 Enter names and addresses of the banking institutions with which your business maintains or will maintain accounts

(give branch

office if applicable).

Name

Address

14 Does the applicant or any person listed on line 10a have a liability for a tax imposed by or pursuant to the authority

of the Tax Law or for the New York City earnings tax on nonresidents that has been finally determined to be due and has

not been paid in full? ........................................................................................................................................................

Yes

No

(If Yes, complete below)

Name

Type of tax

Amount due

Assessment number

Assessment date

15 Has the applicant or any person listed on line 10a been convicted of a crime within the preceding five years? ............

Yes

No

(If Yes, complete below)

Name of person

City and state of arrest

Court of conviction

Date of conviction

Statute section convicted of violating

Disposition

(fine, imprisonment, probation, etc.)

Description of charges

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4