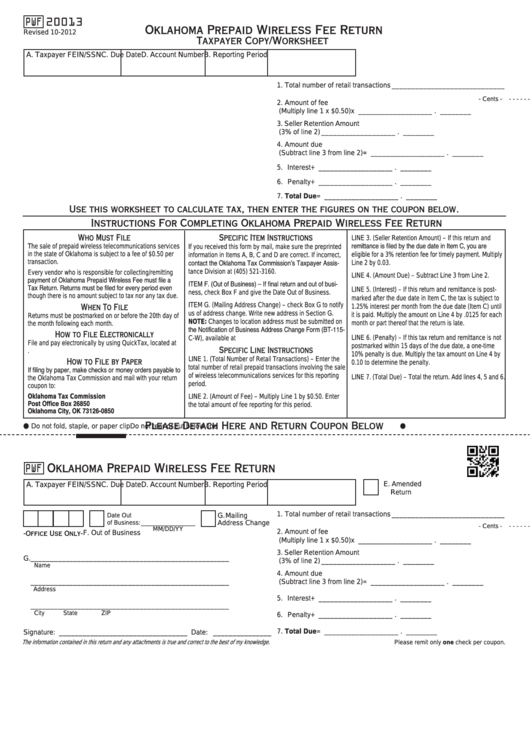

PWF

20013

Oklahoma Prepaid Wireless Fee Return

Revised 10-2012

Taxpayer Copy/Worksheet

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

D. Account Number

1. Total number of retail transactions _____________________________

- - - - - - - Dollars - - - - - - -

- Cents -

2. Amount of fee

(Multiply line 1 x $0.50) .............x ___________________ . ________

3. Seller Retention Amount

(3% of line 2) .............................

___________________ . ________

4. Amount due

(Subtract line 3 from line 2) .......= ___________________ . ________

5. Interest ......................................+ ___________________ . ________

6. Penalty ......................................+ ___________________ . ________

7. Total Due ...................................= ___________________ . ________

Use this worksheet to calculate tax, then enter the figures on the coupon below.

Instructions For Completing Oklahoma Prepaid Wireless Fee Return

Who Must File

Specific Item Instructions

LINE 3. (Seller Retention Amount) – If this return and

The sale of prepaid wireless telecommunications services

remittance is filed by the due date in Item C, you are

If you received this form by mail, make sure the preprinted

in the state of Oklahoma is subject to a fee of $0.50 per

eligible for a 3% retention fee for timely payment. Multiply

information in Items A, B, C and D are correct. If incorrect,

transaction.

Line 2 by 0.03.

contact the Oklahoma Tax Commission’s Taxpayer Assis-

tance Division at (405) 521-3160.

Every vendor who is responsible for collecting/remitting

LINE 4. (Amount Due) – Subtract Line 3 from Line 2.

payment of Oklahoma Prepaid Wireless Fee must file a

ITEM F. (Out of Business) – If final return and out of busi-

Tax Return. Returns must be filed for every period even

LINE 5. (Interest) – If this return and remittance is post-

ness, check Box F and give the Date Out of Business.

though there is no amount subject to tax nor any tax due.

marked after the due date in Item C, the tax is subject to

ITEM G. (Mailing Address Change) – check Box G to notify

1.25% interest per month from the due date (Item C) until

When To File

us of address change. Write new address in Section G.

it is paid. Multiply the amount on Line 4 by .0125 for each

Returns must be postmarked on or before the 20th day of

NOTE: Changes to location address must be submitted on

month or part thereof that the return is late.

the month following each month.

the Notification of Business Address Change Form (BT-115-

How to File Electronically

LINE 6. (Penalty) – If this tax return and remittance is not

C-W), available at

File and pay electronically by using QuickTax, located at

postmarked within 15 days of the due date, a one-time

Specific Line Instructions

10% penalty is due. Multiply the tax amount on Line 4 by

LINE 1. (Total Number of Retail Transactions) – Enter the

How to File by Paper

0.10 to determine the penalty.

total number of retail prepaid transactions involving the sale

If filing by paper, make checks or money orders payable to

of wireless telecommunications services for this reporting

LINE 7. (Total Due) – Total the return. Add lines 4, 5 and 6.

the Oklahoma Tax Commission and mail with your return

period.

coupon to:

LINE 2. (Amount of Fee) – Multiply Line 1 by $0.50. Enter

Oklahoma Tax Commission

Post Office Box 26850

the total amount of fee reporting for this period.

Oklahoma City, OK 73126-0850

Please Detach Here and Return Coupon Below

Do not fold, staple, or paper clip

Do not tear or cut below line

Oklahoma Prepaid Wireless Fee Return

PWF

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

D. Account Number

E. Amended

Return

1. Total number of retail transactions _____________________________

G. Mailing

Date Out

of Business: ________________

Address Change

- - - - - - - Dollars - - - - - - -

- Cents -

MM/DD/YY

2. Amount of fee

-Office Use Only- F. Out of Business

(Multiply line 1 x $0.50) .............x ___________________ . ________

3. Seller Retention Amount

G.

___________________________________________________

(3% of line 2) .............................

___________________ . ________

Name

4. Amount due

(Subtract line 3 from line 2) .......= ___________________ . ________

___________________________________________________

Address

5. Interest ......................................+ ___________________ . ________

___________________________________________________

6. Penalty ......................................+ ___________________ . ________

City

State

ZIP

7. Total Due ...................................= ___________________ . ________

Signature: _________________________________ Date: _______________

The information contained in this return and any attachments is true and correct to the best of my knowledge.

Please remit only one check per coupon.

1

1