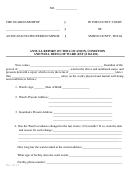

Form C-287 - Telecommunications Annual Report Reporting On 2013 Gross Income - 2014 Page 5

ADVERTISEMENT

(5)

'Mobile telecommunications service' includes, but is not limited to, any one-way or two-way radio communication service

carried on between mobile stations or receivers and land stations and by mobile stations communicating among

themselves, through cellular telecommunications services, personal communications services, paging services,

specialized mobile radio services, and any other form of mobile one-way or two-way communications service.

(6)

'Service address' means the location of the telecommunications equipment from which telecommunications services are

originated or at which telecommunications services are received by a retail customer. If this is not a defined location, as in

the case of mobile phones, paging systems, maritime systems, and the like, 'service address' means the location of the

retail customer's primary use of the telecommunications equipment or the billing address as provided by the customer to

the service provider, provided that the billing address is within the licensed service area of the service provider.

(7)

'Bad debt' means any portion of a debt that is related to a sale of telecommunications services and which has become

worthless or uncollectible, as determined under applicable federal income tax standards.

Section 58-9-2220. Notwithstanding any provision of law to the contrary:

(1)

A business license tax levied by a municipality upon retail telecommunications services for the years 1999 through the

year 2003 shall not exceed three-tenths of one percent of the gross income derived from the sale of retail

telecommunications services for the preceding calendar or fiscal year which either originate or terminate in the

municipality and which are charged to a service address within the municipality regardless of where these amounts are

billed or paid and on which a business license tax has not been paid to another municipality. The business license tax

levied by a municipality upon retail telecommunications services for the year 2004 and every year thereafter shall not

exceed the business license tax rate as established in Section 58-9-2220 (2). For a business in operation for less than

one year, the amount of business license tax authorized by this section must be computed based on a twelve-month

projected income.

(2)

(a) The maximum business license tax that may be levied by a municipality on the gross income derived from the sale of

retail telecommunications services for the preceding calendar or fiscal year which either originate or terminate in the

municipality and which are charged to a service address within the municipality regardless of where these amounts are

billed or paid and on which a business license tax has not been paid to another municipality for a business license tax

year beginning after 2003 is the lesser of seventy-five one hundredths of one percent of gross income derived from the

sale of retail telecommunication services or the maximum business license tax rate as calculated by the Board of

Economic Advisors pursuant to subsection (b). For a business in operation for less than one year, the amount of business

license tax authorized by this section must be computed based on a twelve-month projected income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5