Business Personal Property Rendition - Page 2

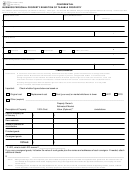

Part Four: Additions During the Reporting Year, or Schedule 3, or 3A

Year Acquired

Item

Total Original Cost or RCN

Item Description

Number

New

Used

Total

Part Five: Deletions During the Reporting Year

Year Acquired

Item

Total Original Cost or RCN

Item Description

Number

New

Used

Total

Part Six: Monthly Inventory

January

February

May

June

March

April

Average

July

August

October

November

December

September

Form 901 Instructions

Who Must File...

Computer Equipment ...

All business concerns, corporations, partnerships and professionals are required

Items included: computer hardware, monitors, drives and other such hardware compo-

by Oklahoma statutes to file each year a statement of taxable assets as of January

nents, custom software is exempt as an intangible.

1, which are located within this county. This rendition must be signed by an owner,

Machinery and Equipment...

partner, officer of the corporation or a bonafide agent.

Items included: auto repair, agricultural, bakeries, barber and beauty shops, cleaning

Penalties...

and laundry, fuel storage tanks, gas pumps, medical, restaurants, signs, theaters, etc..

Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10

All equipment and machinery (forklifts, mobile yard cranes, drilling rigs, tools) is also

percent, or a 20 percent penalty if not filed by April 15th (68 O.S. Section 2836C). If

included. Equipment installed on trucks or trailers after purchase must also be reported.

received through the mail by this office, it must be postmarked no later than March 15th.

Do not list licensed vehicle such as autos, trucks, semitrailers, boats over 10 h.p., etc.

Postage metered mail overstamped by the Post Office after March 15th, will carry the

Forklifts and Construction Equipment...

mandatory penalty.

Items include: forklifts, back hoes, compactor, dozers, draglines, earth movers, graders,

Taxpayers Filing Form 901 in this County ...

mobile cranes, rollers, trenchers, etc.

Attach a complete detailed listing of all TANGIBLE assets used in business,

Tooling, Dies and Molds...

grouped by description, year acquired and original cost, and items that have zero

Items include: Tooling, dies, punches, molds, patterns, jigs, etc.

book value, use reporting Asset Listing 904 Schedule 3 or 3A, which is available

from the county assessor. Report ONLY TANGIBLE ASSETS.

Trade Tools and Equipment...

Include items used by carpenters, cement finishers, craftsmen, electricians, mason,

North American Industry Classification System (NAICS)...

mechanics, repair services, roofers, etc.

This is your six digit Federal Business Activity Code.

★

Leased to Others...

Location of Property...

List lessee, address, asset type, original cost, and age of asset. Additional sheets may be

You must file a separate rendition for each location for assessment allocation to the

attached if necessary.

various school districts.

Original Cost Values or RCN...

★

Leased from Others...

Report the total new or used total cost or replacement cost new, including freight-in and

List lessor, address, asset type, age of asset, and beginning year of lease. Additional

installation costs. Do not deduct investment credit, trade-in allowances or depreciation.

sheets may be attached if necessary.

If unknown, estimate the original cost. Estimated costs will not be depreciated without

Inventories...

supporting documents.

Add your total monthly inventories. Then divide the sum by the number of months you

Year Acquired...

have inventory in this county for the year to determine your average inventory. Invento-

This is the purchase date. Depreciation cannot be calculated unless the year acquired is

ries held for others or cosigned must be reported separately. Inventory claimed exempt

reported.

must be accompanied by a Freeport Exemption Form (901-F).

Leasehold Improvements...

If the Business is Sold, Closed or Name Changed...

Report cost and detailed description of improvements to property owned by others. Do

To avoid possible incorrect or duplicate assessment, taxpayers should provide information

not report building expansions or repairs, rough plumbing or electrical service, which are

as follows:

included in real estate values. Report all other items such as partitions, new store fronts, etc.

• Business Sold: date of sale, name and address of new owner.

• Business Closed: date of closing or date all personal property was disposed, report

Furniture and Fixtures...

location and value of any remaining property still owned on the assessing date,

Items included: office desks, chairs, credenzas, file cabinets, table booths, shelving

even if in storage.

display cases, racks, gondolas, retail fixtures, hotel and motel furnishings, etc.

• Business Name Change: date of change and new name.

Electronic Equipment ...

Intangible Business Personal Property...

Items included: calculators, copiers, drafting machines, blueprinting machines, fax

If any intangible property is imbedded in the reported assets the intangible property must be

machines, postage machines, telephone equipment, typewriters, lunch room appliances,

identified and valued to the county assessor with supporting documentation. Supplemental

etc. Also, include electronic and computer controls used with machinery and equipment.

Form 901-IP must be used for any submission.

1

1 2

2