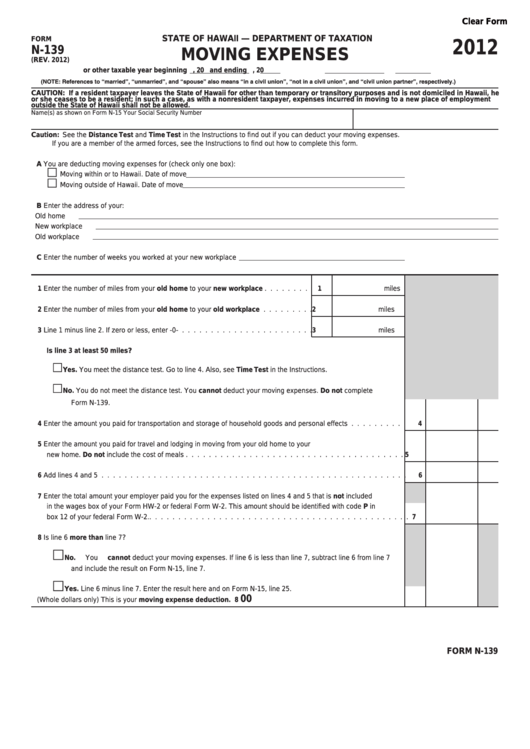

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

2012

N-139

MOVING EXPENSES

(REV. 2012)

or other taxable year beginning

, 20

and ending

, 20

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

CAUTION: If a resident taxpayer leaves the State of Hawaii for other than temporary or transitory purposes and is not domiciled in Hawaii, he

or she ceases to be a resident; in such a case, as with a nonresident taxpayer, expenses incurred in moving to a new place of employment

outside the State of Hawaii shall not be allowed.

Name(s) as shown on Form N-15

Your Social Security Number

Caution: See the Distance Test and Time Test in the Instructions to find out if you can deduct your moving expenses.

If you are a member of the armed forces, see the Instructions to find out how to complete this form.

A You are deducting moving expenses for (check only one box):

Moving within or to Hawaii. Date of move

Moving outside of Hawaii. Date of move

B Enter the address of your:

Old home

New workplace

Old workplace

C Enter the number of weeks you worked at your new workplace

1 Enter the number of miles from your old home to your new workplace . . . . . . . .

1

miles

2 Enter the number of miles from your old home to your old workplace . . . . . . . . .

2

miles

3 Line 1 minus line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . .

3

miles

Is line 3 at least 50 miles?

Yes. You meet the distance test. Go to line 4. Also, see Time Test in the Instructions.

No.

You do not meet the distance test. You cannot deduct your moving expenses. Do not complete

Form N-139.

4 Enter the amount you paid for transportation and storage of household goods and personal effects . . . . . . . . . .

4

5 Enter the amount you paid for travel and lodging in moving from your old home to your

new home. Do not include the cost of meals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Enter the total amount your employer paid you for the expenses listed on lines 4 and 5 that is not included

in the wages box of your Form HW-2 or federal Form W-2. This amount should be identified with code P in

box 12 of your federal Form W-2.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Is line 6 more than line 7?

No.

You cannot deduct your moving expenses. If line 6 is less than line 7, subtract line 6 from line 7

and include the result on Form N-15, line 7.

Yes. Line 6 minus line 7. Enter the result here and on Form N-15, line 25.

00

(Whole dollars only) This is your moving expense deduction.

8

FORM N-139

1

1 2

2