IT-604 (2013) Page 3 of 8

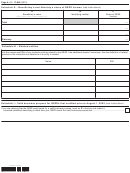

Zone allocation factor

Schedule D

–

(see instructions)

–

–

A

EZ

B

New York State

.

.

14 Average value of property

...................... 14

14

(see instructions)

00

00

15 EZ property factor

15

(divide line 14, column A, by line 14, column B; round the result to the fourth decimal place)

.

.

16 Wages and other compensation of employees

16

16

(see instr.)

00

00

(divide line 16, column A, by line 16, column B; round the result to the fourth decimal place)

17 EZ payroll factor

17

(add lines 15 and 17)

18 Total EZ factors

............................................................................................. 18

(divide line 18 by two; round the result to the fourth decimal place)

19 Zone allocation factor

................... 19

Partnerships – Enter the line 19 amount on Form IT-204, line 134 and enter the benefit

period factor from the Benefit period factor table below on Form IT-204, line 135.

All others – Enter the line 19 amount on line 27.

Schedule E – Tax factor

20 Enter your tax from Form IT-201, line 39; Form IT-203, line 38; Form IT-205, line 6 (full-year resident

.

estate or trust); or Form IT-205-A, line 11 (nonresident estate or trust or part-year resident trust) 20

00

.

21 Enter the amount of your income from the QEZE allocated within NYS

............ 21

(see instructions)

00

.

22 New York adjusted gross income

....................................................................... 22

(see instructions)

00

23 Divide line 21 by line 22

.... 23

(the result cannot exceed one; round the result to the fourth decimal place)

.

24 Multiply line 20 by line 23; this is your tax factor

................................... 24

(enter here and on line 28)

00

Schedule F – QEZE tax reduction credit

(see instructions)

25 Tax year of the business benefit period

; benefit period factor

........ 25

(from table below)

26 Employment increase factor

.................................................................................... 26

(from line 13)

1.0000

(from line 19)

27 Zone allocation factor

............................................................................................... 27

.

(from line 24)

28 Tax factor

................................................................................................................. 28

00

.

29 QEZE tax reduction credit available for use

(multiply line 25 × line 26 × line 27 × line 28)

................ 29

00

.

30 Tax due before credits

....................................................................................... 30

(see instructions)

00

.

31 Credits applied against the tax before this credit

............................................... 31

(see instructions)

00

.

32 Net tax due

........................................................................................ 32

(subtract line 31 from line 30)

00

.

33 QEZE tax reduction credit used for the current tax year

.................................... 33

(see instructions)

00

Sole proprietors and fiduciaries

Find the tax year of your benefit

–

Benefit period factor table*

period. Enter the benefit period factor for that tax year on line 25.

Tax year of the benefit period

Benefit period factor

–

All others

See instructions.

1 - 10

1.0

For taxpayers first certified prior to April 1, 2005, the QEZE

*

11

.8

tax reduction credit is generally available for up to 14 years for

12

.6

taxpayers that continue to qualify.

13

.4

14

.2

15

0

164003130094

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8