Form 54-130 - Iowa Rent Reimbursement Claim For Elderly Or Disabled - 2012 Page 2

ADVERTISEMENT

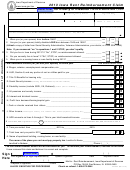

Reimbursement Amount

If you would like to compute the rent reimbursement amount, complete the worksheet below. If you

would like the Department to compute the rent reimbursement for you, leave the worksheet below blank.

.

,

0 0

a. Total household income from line K (front page)

$

Is Line K (front page) $21,335 or greater? If yes

; no reimbursement is allowed.

STOP

.

0 0

,

$

b. Enter total rent you paid from line 7.

.23

c. Allowable percentage

X

.

$

,

0 0

d. Rent allowed for reimbursement. Multiply line b

by line c (can’t be more than $1,000)

(example: if line b = 500, multiply 500 X.23 = 115)

NOTE: If more than $1,000, enter $1,000 on line d.

e. Select rate from table below based on your income from line a above:

$ 0.00

-

$10,990.99 ....... enter 1.00

.

X

$10,991

-

$12,283.99 ....... enter 0.85

$12,284

-

$13,576.99 ....... enter 0.70

$13,577

-

$16,162.99 ....... enter 0.50

$16,163

-

$18,748.99 ....... enter 0.35

$18,749

-

$21,334.99 ....... enter 0.25

$21,335 or greater ..................... STOP. No reimbursement allowed

.

0 0

,

$

f. Estimated reimbursement. Multiply line d by line e.

(example: line d = 115, multiply 115 by .70 = 81)

This amount cannot be more than $1,000.00.

WHO IS ELIGIBLE?

1. You lived in Iowa all or part of 2012, and live in Iowa now, and

2. Your household income is less than $21,335, and

3. The rental unit you lived in is subject to property tax, and

4. You (or your spouse) were born before 1948, or

5. You (or your spouse) were age 18 to 64 as of December 31, 2012 and totally disabled. Totally disabled

means you are unable to get a job paying more than $1,010 per month due to a physical or mental

disability which has lasted, or is expected to last for at least one year. Proof of disability must be

attached to your claim.

Married couples living together are considered one household and can file only one claim, combining both

incomes. If they do not live together, they may file separate claims. Other persons living together who qualify for a

reimbursement may each file a claim based on their income and share of rent paid.

If you lived in a nursing home or care facility, contact the administrator for the amount to enter on line C, Title 19

benefits. Or, enter 20% of benefits if living in a nursing home, or 40% if living in a care facility.

FILING TIPS

·

Complete and sign rent reimbursement form

·

With your claim, send proof of disability (copy of letter from Social Security, VA, or your doctor)

·

To see a list of locations offering assistance with this form, please see our Web site at

Check on refund: 1-800-572-3944

Allow 3 months for processing.

54-130b (10/11/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2