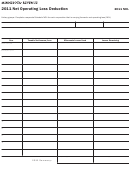

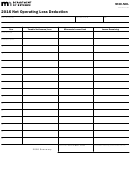

Schedule NOL Instructions

The purpose of this form is to show the

erating loss at the apportionment percent-

• If the amount is a loss, add it to the total

in the previous year’s Losses Remaining

sources and applications of net operating

age of the loss year.

column and enter the sum in the Losses

losses. Only the years used to calculate the

Corporations may not create or increase the

Remaining column.

net operating loss, and the years the losses

net operating loss by:

are used, need to be listed.

• If the amount is income, and losses from

• the deduction for dividends received,

previous years are being used to reduce

Net operating losses may be carried forward

Form M4T, line 8b;

that income, enter the amount of loss

only. The carryforward period is 15 years.

• the contributions deduction for tax years

being used to reduce the income in the

A net operating loss incurred in a prior year

Minnesota Losses Used column.

beginning before 2001; or

and not previously used to offset net income

• the foreign royalties subtraction for tax

Complete Schedule NOL and attach a copy

may be deducted on Form M4T, line 6 or

years beginning before 2013.

with your Minnesota tax return.

Form M4NP, line 5.

See Revenue Notice 99-07 if an IRC section

A separate Schedule NOL is required for

Corporations and nonprofit organizations

382 limitation applies.

each corporation in a unitary group that is

whose business is conducted entirely in

claiming a net operating loss deduction.

Minnesota may deduct the full amount of

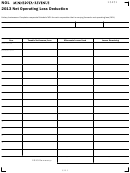

To complete the worksheet:

any previously unused net operating loss.

• Enter your taxable net income or loss, or

income for the year in the Taxable Net

Corporations and nonprofit organizations

Income/Loss column.

that apportion their income to Minnesota

may deduct any previously unused net op-

Example:

Year

Taxable Net Income/Loss

Minnesota Losses Used

Losses Remaining

Oldest loss year

12/31/07

(7,000)

--------

(7,000)

Subsequent year 1

12/31/08

4,000

(4,000)

(3,000)

2

12/31/09

(5,000)

(8,000)

3

12/31/10

6 ,000

(6,000)

(2,000)

4

12/31/11

(13,000)

--------

(15,000)

5

12/31/12

14 ,000

(14,000)

(1,000)

6

12/31/13

9,000

(1,000)

0

7

8

9

10

11

12

13

14

15

Net operating loss deduction

Total losses remaining (to be carried forward)

2013 Summary:

1,000

--------

Enter on M4T, line 6 or M4NP, line 5

1

1 2

2